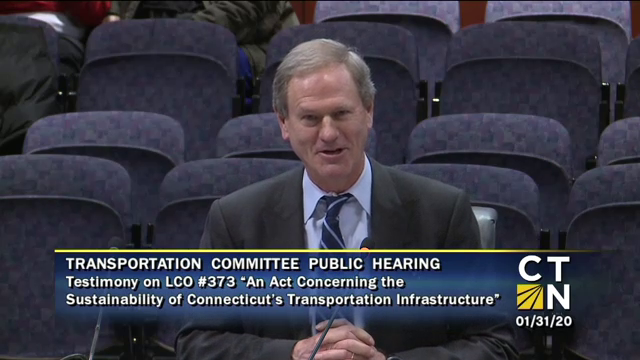

Connecticut is Not New York City, Where Strict Shutdown Policies Are Needed. CT Governor Lamont Should Issue and Follow Evidence-Based Connecticut-Specific Guidelines For Continuing His Schools and Business Shutdown and, Ultimately, For Lifting It.

CT Examiner, Republican American, CT Hearst newspapers - March 22 -26 ... The coronavirus is not the only threat we face. As I wrote in The Hill on last Thursday (3/19) and The Wall Street Journal editorialized last Friday, the 20th,, we may face a far greater threat from a collapsed economy, which would devastate everyone’s financial resources and their medical condition.

This should be of special concern in Connecticut which entered the current crisis already economically anemic and financially shaky.

While this may not be popular to say, we should rethink shutdown policies in Connecticut. Actually, it may not be unpopular. A new Pew Research

Center poll shows that 70 percent of Americans see the virus as a major threat to the economy, while only 27 percent see it as a major threat to their own personal health.

It should be a priority to keep people working and return to work the tens of thousands suddenly being idled. The Connecticut Labor Department received 56,000 unemployment claims in the first four days this past week versus a weekly average of 2,500.

A deep recession or depression would bring an inevitable deterioration in public health along with economic pain. It would push us backward down the Preston Curve, which demonstrates that life expectancy varies directly with income level: wealthy societies are relatively healthy, poor ones less so.

We should balance the “incidence curve” with the Preston Curve, putting as much effort into moderating economic devastation as we put into flattening the incidence, or infection, curve to keep coronavirus hospitalizations below hospital capacity.

Continue Reading: