As the new year dawns, Ned is in a fix. Should he finally freeze wages or deliver another pay raise?

His two-term predecessor, Democrat Dannel Malloy, froze state employee wages three times, leading the Hearst newspapers in Connecticut to run my recent column with a headline asking the pointed question “Why Can’t Lamont Freeze Wages?”

Trouble is, last spring Ned promised a state employee union convention “Every year that I’ve been here you’ve gotten a raise, and every year I’m here, you’re going to get a raise.”

Lamont was “here” in 2025, but state employees did not get a raise. They have been working without a wage contract since last June 30th.

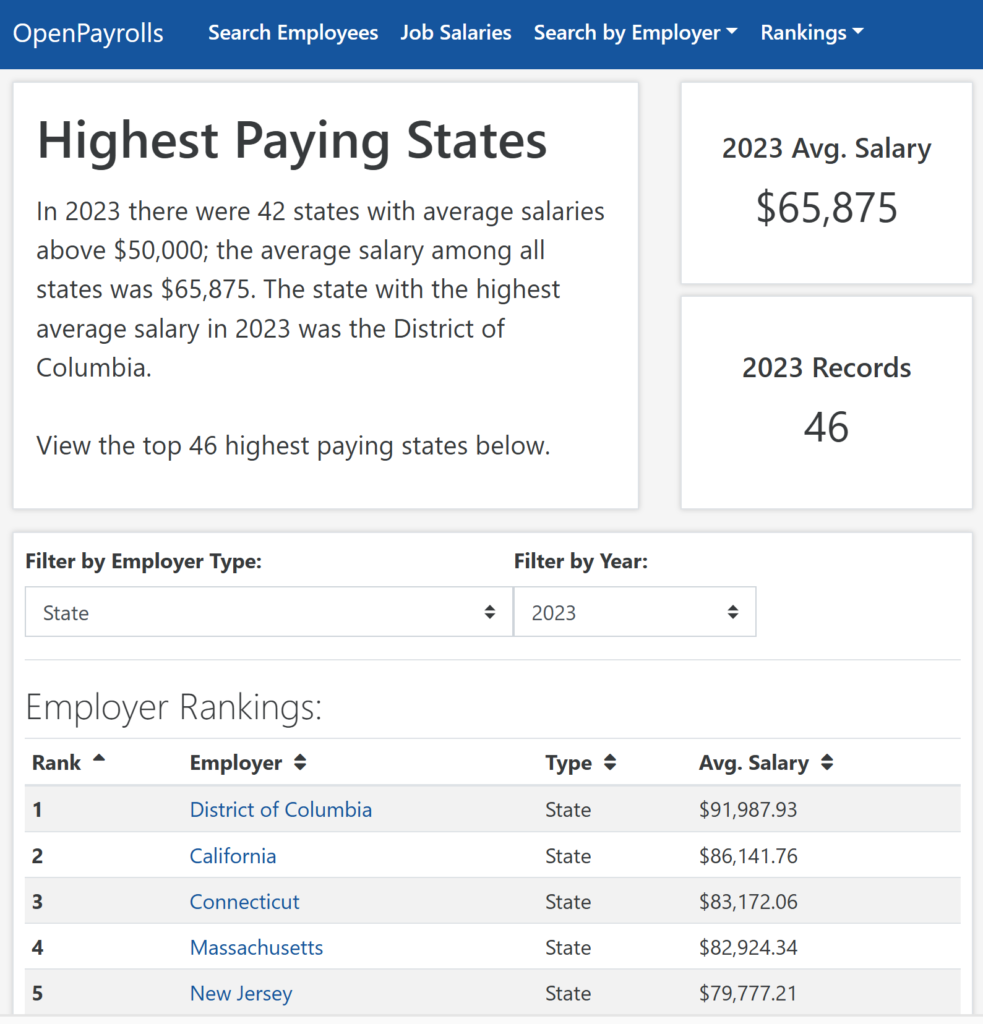

State employees have received annual pay raises every one of Ned’s first six years in office. The raises compound to a whopping 33%, super-rich wages that surely prompted the Hearst headline implicitly asking “isn’t that enough?”

Can Ned deliver a seventh consecutive annual pay raise?

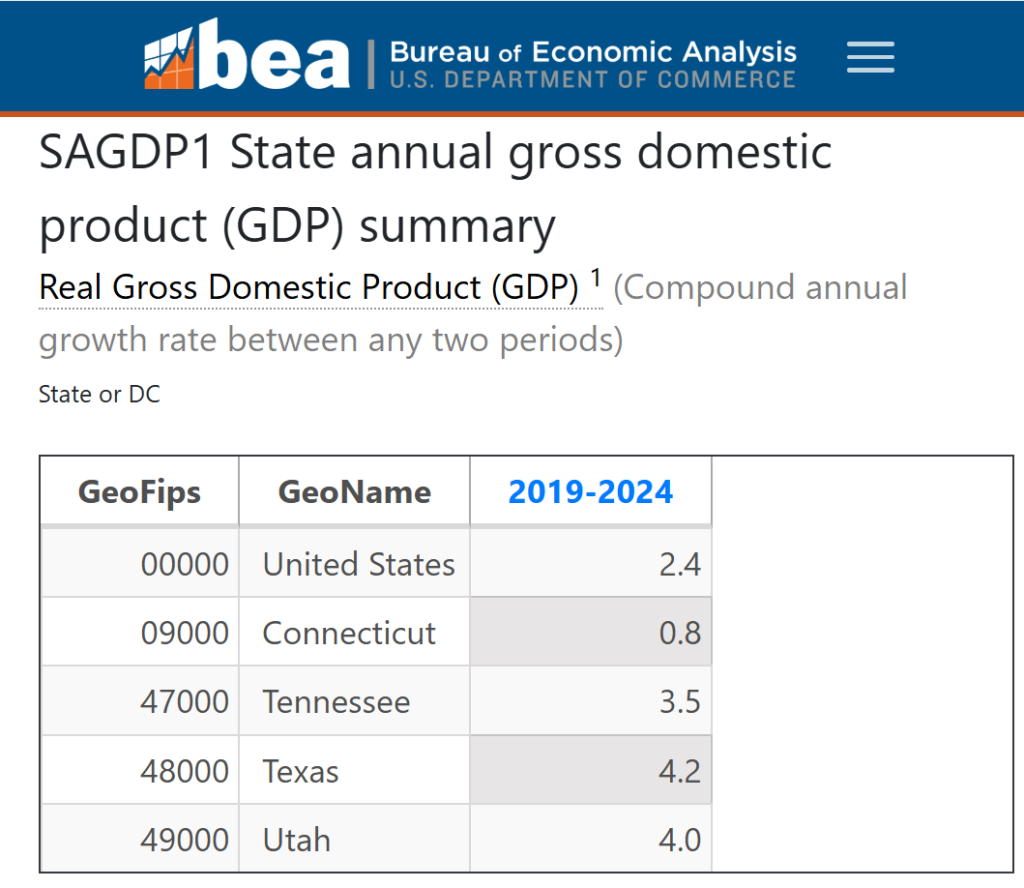

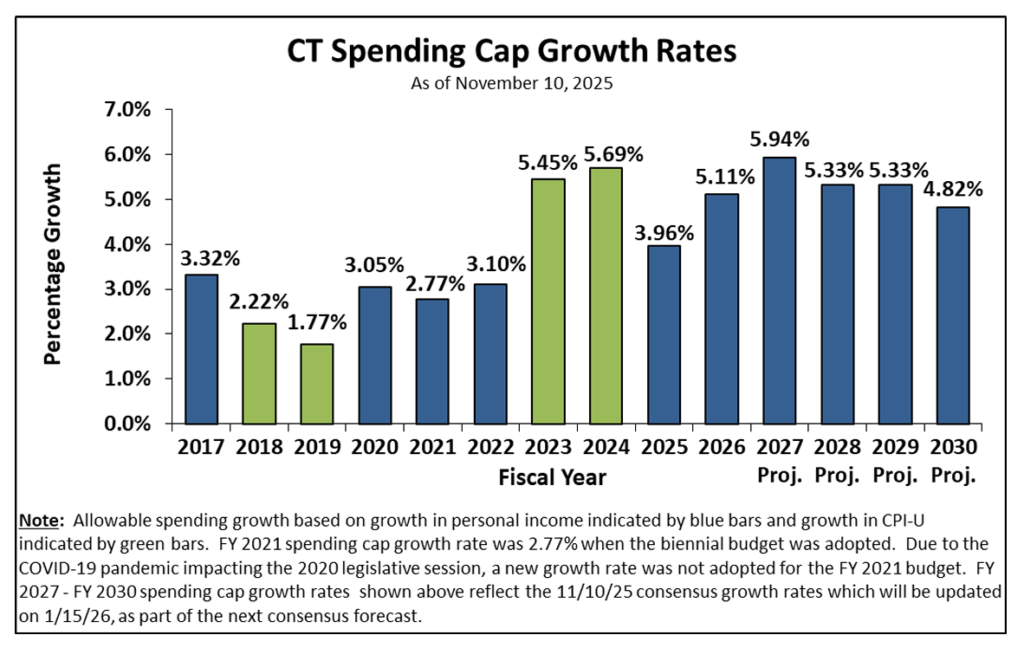

Maybe he meant the current fiscal year, FY 2026, ending next June? If so, he has got a problem. According to budget rules, spending can’t exceed growth in the state’s economy (or the rate of inflation, if higher). Ned’s problem is two-fold: too much spending and too little economic growth. He and his fellow party members in the General Assembly budgeted too much spending and there was “no room under the spending cap to pay raises to most state workers [in fiscal 2026],” as the CT Mirror reported late last spring. Once set, the spending cap is fixed for the year.

What to do?

The challenge is seemingly insurmountable, right? Nope. Not when it comes to delivering the goodies to state employee unions.

Already last spring the fix was in. As CT Mirror suggested then, Ned is likely to award a fiscal 2026 wage increase to be paid retroactively in fiscal 2027… when, according to plan, there will be more economic growth, and more spending room.

Actually, the spending cap calculation does not use economic growth, but rather growth in personal income in the state. There is a crucial difference. The state’s own economy is moribund; regular private sector workers in the state are seeing little income growth.

Yet, the state is home to an unusually large population of professional investors whose personal income has been stratospheric in recent years, based upon ginormous stock market gains.

The dichotomy is stark. Despite Lamont’s crowing about a “Connecticut Comeback,” the state’s real GDP grew at an anemic annual compound rate of 0.8 percent from 2019 to 2024, according to the Bureau of Economic Analysis, and only 0.2 percent annualized from $288 billion in the fourth quarter of 2024 to $291 billion in the second quarter of 2025.

In contrast, the stock market has skyrocketed 86%, as the S&P Index has surged from 3701 in 2019 to 6896 at year-end 2025. The stupendous personal income growth of the relatively small cadre of professional investors has pushed up overall average personal income and the spending cap.

Moreover, during the market’s recent rocket ride, actual tax revenue from those investors has been so robust that it has exceeded the spending cap, leading to the anomaly of “surpluses” coincident with restrictions on spending. Spending has been squeezed further by the priority given to the lavish annual pay increases for state employees. The squeeze on spending from ever-increasing state pay would be the logical reason the Hearst newspapers suggested a wage freeze.

In addition, there’s always the risk that the stock market might not continue on its rocket ride, leading to an even lower spending cap and less revenue.

If this were to happen, Ned’s plan for a retroactive pay raise would leave him in a real fix. It would be difficult to justify paying state employees even higher wages (already the second highest in the 50 states). Money would have to be taken from other priorities – less education spending, less health care spending, less spending on roads and highways…

Since the budgets are set for future years before the actual personal income figures (or the inflation rates) are known, there’s room for wishful thinking. The cap increased 5.1% in FY 2026 and is projected to increase to a 10-year high of 5.9% in FY2027, when Ned plans to award that retroactive pay raise.

If things sour, maybe Ned will play the game for another year or two: still paying a fiscal 2026 raise retroactively in fiscal 2027 and, then, deferring a fiscal 2027 raise to be paid retroactively in fiscal 2028 and so on. Yet, that kind of thing can catch up with you. Eventually, the retroactivity goes up in smoke and people realize that you have skipped a year … but only after Ned’s been elected to a third term.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.