Some news media coverage of Connecticut state employee compensation misinforms the public. Periodic news articles titillate readers with the pay of the state’s highest earners. Yet, six high-paid UCONN athletic coaches and 33 high-paid UCONN Health doctors are not the reason that the overall state payroll has exploded under Governor Lamont.

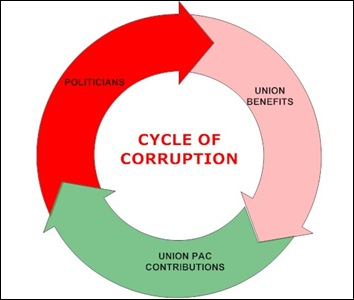

The problem is that Lamont is giving away the farm. He has awarded the unionized workforce six consecutive annual wage increases that have driven up pay by a stunning 33%. And he is poised to award a seventh. Instead, he should freeze wages.