During his re-election campaign – and ever since, Governor Lamont has claimed credit for a Connecticut Comeback and for “progress on pensions.” Yet long-term debt has increased $3 billion. The unfunded liability of the state employee pension fund (SERS) has barely improved, despite that the state has put a whopping $5 billion in special deposits into it. The latest news on the economy is that Sikorsky will be laying off 400 workers. Where’s the Comeback? Where’s the progress on pensions?

When did you last hear of a major business moving into Connecticut?

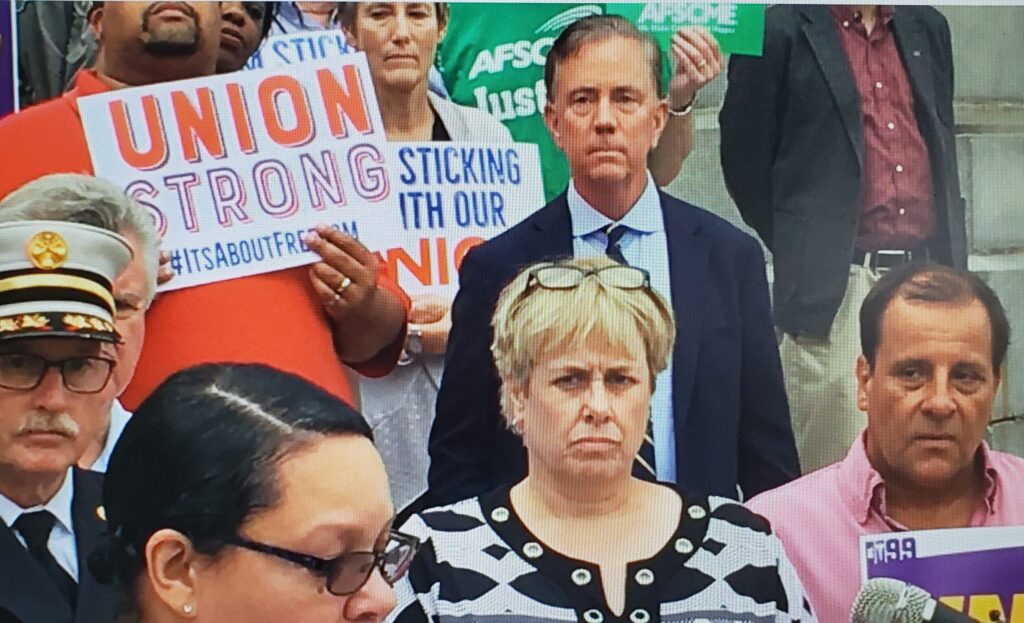

This week every Democrat in the General Assembly voted for Governor Lamont’s 4.5% state employee wage increase for next fiscal year that will bring wage increases during Lamont’s time in office to an eye-popping 33% total increase. A state employee making $100,000 just prior to Lamont’s inauguration will get $133,000 next year. Nice pay if you can get it, and 46,000 unionized state employees will get it.

Just to be clear, under Lamont, state employees will have received six consecutive annual wage increases (including 2% average “annual increments”): 5.5%, 5.5%, 4.5%, 4.5%, 4.5% and next fiscal year’s 4.5%. Those figures compound to 33%.

State employees were not underpaid beforehand. Just the opposite. Over the 2017 to 2019 period, Connecticut state employees received total compensation that was 33% higher (yet another but different 33%) than comparable private sector workers in the state, according to nationally recognized pension expert Andrew Biggs in a study commissioned by Nutmeg Research Initiative and overseen by The Townsend Group, which I head. The 33% premium was the fifth highest of the 50 states, while Connecticut ranks 46th in the funding of its pensions.

Connecticut residents pay taxes so that unionized state employees can make 33% more than tax-paying citizens in comparable jobs. How is that fair? Where are the Democrats’ social justice warriors on this issue of fairness? Does a single Democrat stand up to the all-powerful unions?

How does it drive an economic “Comeback?” Businesses cannot hire employees when the state outbids them for talent by 33%. No wonder the state economy is stagnant, growing only 0.2% in real terms from 2017 to 2022 versus 2.2% for the nation, according to the Bureau of Economic Analysis.

Why is there virtually no progress on the SERS pension fund? Pension benefits are calculated off wage levels. When wages increase 33%, future pension costs rise in tandem. In the June 2018 Report of the Actuary just before Lamont took office, the estimated aggregate future pension costs of SERS were $34.2 billion; last June, they were $42.0 billion.

In its reports, the Actuary, Cavanaugh Macdonald, said it did not change its methodology, and the number of covered state employees actually declined slightly. So, the $7.8 billion increase can only result from increased wages under Lamont.

The point of pension funds is to devote a portion of annual state revenue to develop and maintain a portfolio of financial assets that will be sufficient to pay future pension costs. The difference between the total estimated future pension costs and the value of the assets in the pension fund is called the “unfunded liability.”

How has Connecticut under Lamont fared on this score? SERS’ unfunded liability has improved by just $1.1 billion, despite the $5 billion in special deposits into it. The unfunded liability before Lamont took office was $21.2 billion; last June it was $20.1 billion. That’s not “progress.”

Other factors are involved. SERS makes benefit payments to current retirees which reduce the fund, while investment of SERS assets should produce a return that grows the fund. These factors are largely out of the Governor’s control.

Yet, Lamont has mismanaged those aspects of pensions that are under his control. In the SEBAC 2022 wage agreement, Lamont cut a hairbrained deal. In mid-June before the June 30th effective date for modest reductions in retirement benefits for subsequent retirees, he paid state employees huge “pensionable” bonuses and lumpsum retroactive pay raises averaging over $4,000. Many employees banked the payments and retired days later before July 1st and avoided the benefit reductions. Anyone serious about pension progress would have scheduled any payments after June 30th.

So many employees retired that the state had to rehire hundreds as temps to fill staff shortages. Avoidance of the benefit reductions and the payment of “pensionable” bonuses increased aggregate future pension costs.

Lamont is unserious, or worse. With his overgenerous wage deals, he has stymied progress on pensions.

The fiscal condition of the state is perilous, with one of the highest levels of debt per-capita in the nation. This serious and dismal reality has been hidden by the torrent of federal COVID assistance which has gushed into the state under Lamont. That gusher is over. Soon, Connecticut will have to pay the piper.

It is rumored that Lamont may run for a third term. Hopefully not. Voters deserve a serious candidate.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.