Connecticut Governor Ned Lamont just got caught with his hand in Uncle Sam’s cookie jar. For the last eight months, he has offered various far-fetched explanations claiming that the One Big Beautiful Bill Act, and its prohibition on hospital tax rate increases, did not apply to Connecticut.

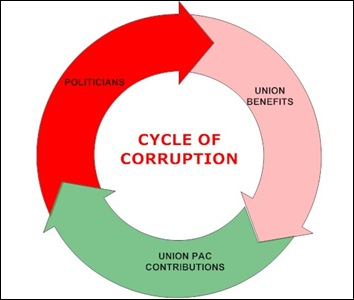

Last summer, he jacked up Connecticut’s tax on hospitals almost 50%. The hospital tax is a shell game enabling states to obtain federal money simply by shifting money around: extracting taxes from hospitals, and, then, immediately returning most of it, with the return triggering matching federal funds. The higher the tax, the more federal dollars obtainable.

A month ago, he got caught and had to reverse his tax increase.

Lamont thought he could take one more big beautiful bite out of Uncle Sam before the OBBBA took effect. His increase took the hospital tax up to $1.2 billion, or 7.4% of Connecticut hospitals’ most recently reported $15.8 billion of net patient revenue, according to Lamont’s spokesperson.

Hospital taxes are not supposed to exceed 6% of net patient revenue. To go over that level, states need a waiver from Center for Medicare and Medicaid Services (CMS).