Most of the time, leadership simply entails going first. State Representative Tina Courpas has just introduced the first bill in this session of the Connecticut General Assembly “to freeze wage and salary increases for state employees for a period of at least two years.” Most Republicans should and will follow.

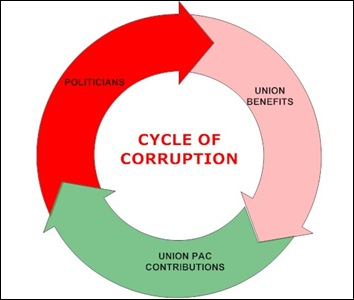

So should Democrats willing to put the common good before their party's interests. They will need courage to buck the vice grip that the public sector unions have on the Democrat party.

CT state employees have already received six consecutive annual wage increases under Governor Lamont, cumulating to 33%, bringing their current average wages to the grandiose level of $95,000.

Why does this matter? Because state employee wages set the pace for municipal wages. And when municipal wages go up, so do property taxes, which are the only source of revenue from which towns can pay wage increases.