On Friday, January 31st, the Transportation Committee of the CT General Assembly held a public hearing on Governor Lamont’s new 12-gantry heavy-trucks-only tolls proposal. Red Jahncke testified, along with many other members of the public. Above is the CT Public Affairs Network broadcast of Jahncke’s testimony. The full nine hours of testimony can be accessed here: http://ct-n.com/ctnplayer.asp?odID=17098 Below is a transcript of Jahncke’s testimony. In a few places, supplementary information has been added in brackets to clarify the testimony.

Red Jahncke: I haven’t gotten a call all night, and, then, when I sit at the testimony table, I get two. My apologies.

I think Connecticut has an unusual liability in trying to install tolls of any kind. Most toll roads are limited-access highways. Connecticut has open-access highways. The Mass Pike is 140 miles. There 24 access points. I-95 [in CT] is 105 miles. There are 91 access points.

In Massachusetts, if somebody wanted to dodge a toll, they would have to get off and drive 6 miles on local roads and re-enter the Mass Pike. They’re not gonna do that. The experience in Massachusetts reveals that.

I submit to you, in Connecticut, to get off and dodge a gantry, you only have to drive one mile on local roads to do so. That invites substantial toll evasion, whether that’s trucks or cars. I would substantiate my layman’s assertion of that point with the professional assertion of CDM Smith in their April 2015 study for the Department of Transportation where on page 12 they recommended the spacing of toll gantries every 4 to 5 miles, and, if you did not do that, you were exposing yourself to substantial toll evasion. Well 5 gantries over the entire length of I-95 is a separation of over 20 miles.

So, the point here is I don’t think you’re gonna raise the $230 million gross of total revenue that is in the governor’s plan.

So, Representative Devlin, when you interacted with the prior witness, talking about the emergency [a financial emergency under which tolls could be extended to cars], it is not unlikely that toll revenue under this plan would come in substantially below the projection. In my layman’s opinion, buttressed by this assertion in CDM Smith’s report, that would trigger a situation where bonds which were issued in a like amount to the $230 [million] to be paid off by $230 [million of toll] revenue would all of a sudden be in jeopardy and that could trigger an emergency.

The other element of the plan that raises suspicion in my mind is the revenue projection itself. Now the governor started with a projection of $800 million of total revenue from at 50-gantry program, tolling all vehicles. So now we’re down to 12 gantries and trucks only. Trucks are 5% of traffic. 12 gantries is a reduction to 24% of the prior proposal. So multiplying 24% by 5%, you get a combined system reduction to 1.2%.

The proposed collection system, if you will, is 1.2% of what the governor originally proposed. So how, then, does what he is proposing now raise 29% of the original $800 million? ($230 of $800 million). I am skeptical that a system that’s been reduced to 1.2% of its prior configuration is gonna raise 29% of the original configuration.

So, on those two levels, I have skepticism about the revenue generation from this tolls plan.

So, if that tolls plan is not going to work — let’s posit that the logic I asserted has enough merit to discuss other options — and we go back to what Mayor Bronin [Mayor of Hartford] said, which is it’s either tolls or taxing the taxpayers, — and, then, I’ll reference what Mr. McGee [ Joseph J. McGee, VP – Public Policy and Programs, Business Council of Fairfield County] was just talking about, which is the structural problems in the state budget. It seems like, in all of these conversations, when the conversation gets to that level, it’s always a euphemistic word, “structural problem.”

Well, I’d like to assert that the structural problem is the over-compensation of state employees –wages, health care benefits and retirement benefits, all of which are amongst the highest in the nation and, in several years, the highest in the nation. Why are not we addressing that issue, not with [the] euphemistic term of “structural problem,” but calling it exactly what it is, and holding hearings on that?

I submit to you, if you have problems in life, a better philosophy is to address the biggest problem you have [first]. If you address directly the biggest problem you have, a lot of the other problems go away, as they are, in fact, subsidiary to that larger problem. So, I think the way to fund transportation in this state is to cut state employee wages, healthcare benefits and retirement benefits, and that’s the way of fund transportation – and, by the way, all the other needs of this state.

Senator Leone, Committee Chairman (D-Stamford): Thank you. Questions are [from] Representative O’Dea followed by Representative MacLachlan.

Representative O’Dea (R-New Canaan, Wilton): Thank you so very much for your testimony. I don’t know if you were here when I ask the state DOT engineer whether or not he knew that Connecticut was the only state, at least upon information that I was given, where the public sector was making more than the private sector in similar jobs and he said that was absolutely false. I note that you had just said that maybe I was right. Can you just expound on where you got your information on that?

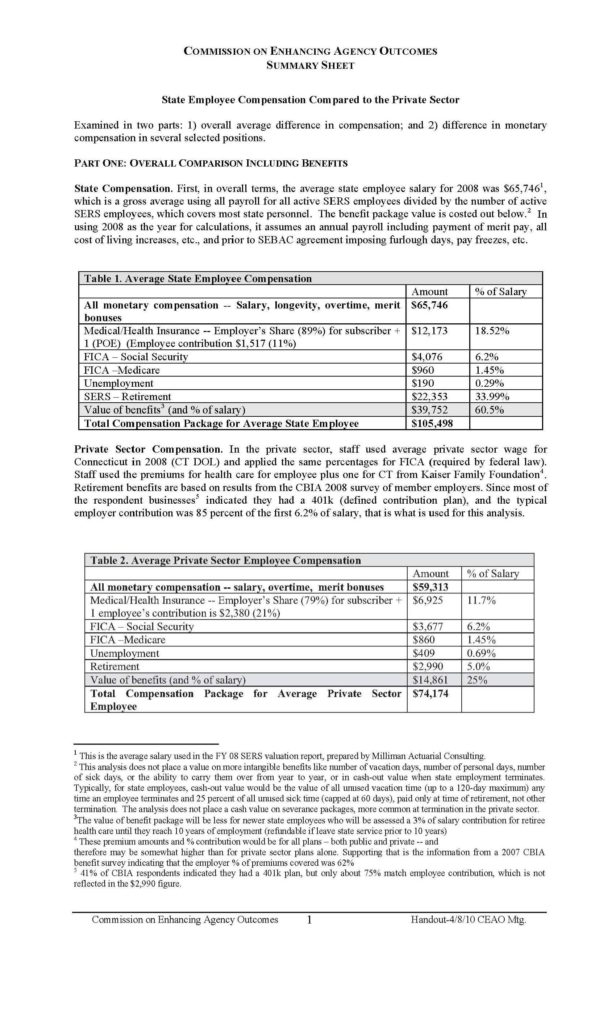

Jahncke: I am a happy to do so. I actually have it here. It began with a state commission, the Commission on Enhancing Agency Options, which reported in 2010. It presented a comparison of state employee compensation relative to private sector compensation. On the wage level –these are, bear with me, these are small figures on my computer to read, in the private sector wages averaged $59,000 and change [versus] state employees $66,000 rounding up from slightly less. For total compensation, in the private sector $74,000 and change [and for] state employees $105,000.

Representative O’Dea: Can you email us that — to the committee?

Jahncke: I would be happy to do so. That is, that is a Connecticut state commission, the Commission on Enhancing Agency Options

Representative O’Dea: And what is the date of that?

Jahncke: That is 2010 [based upon 2008 data].

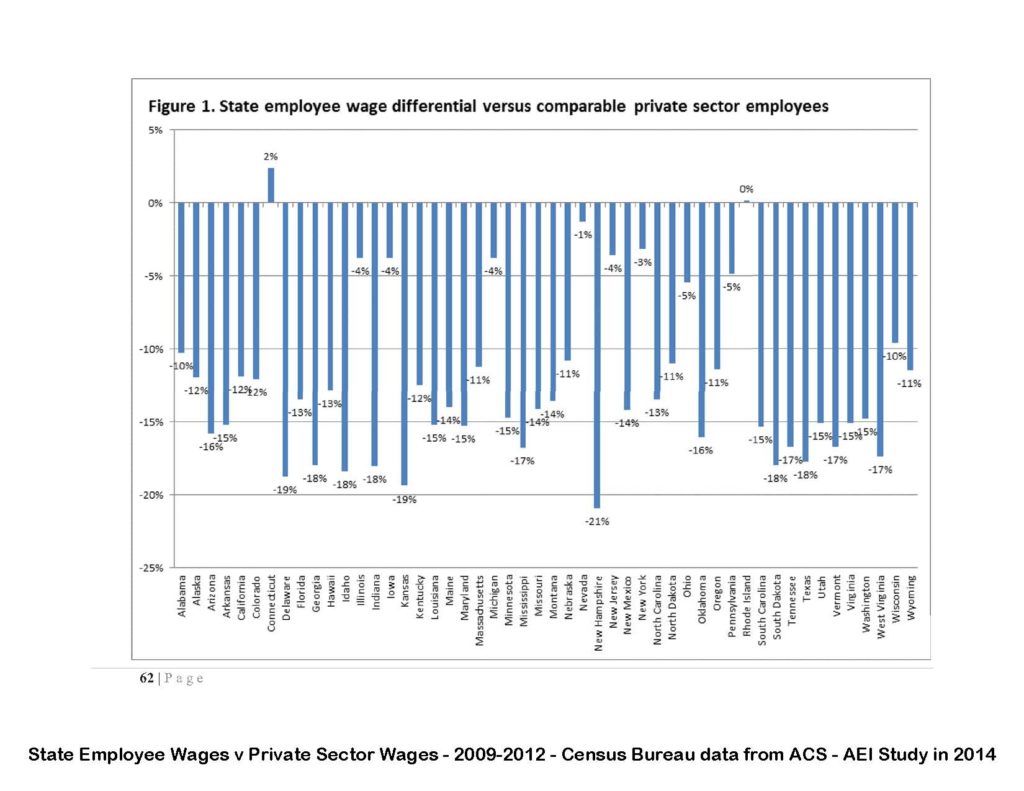

At about, based on somewhat later data, the American Enterprise Institute conducted a study of all 50 States (https://www.aei.org/wp-content/uploads/2014/04/-biggs-overpaid-or-underpaid-a-statebystate-ranking-of-public-employee-compensation_112536583046.pdf.)

So let me let me stipulate ahead of time that when you are being compared to 50 other States, there is no way that anyone can complain that somebody is jimmying the numbers about Connecticut. That would presuppose ulterior motive, and why would anyone doing a study of 50 States have it in for a Connecticut? So these are across-the-board, level playing field [results].

There was only one state in the nation [Connecticut] where wages, the state employee wages, exceeded private, average private, sector wages.

Representative O’Dea: As of what date was that?

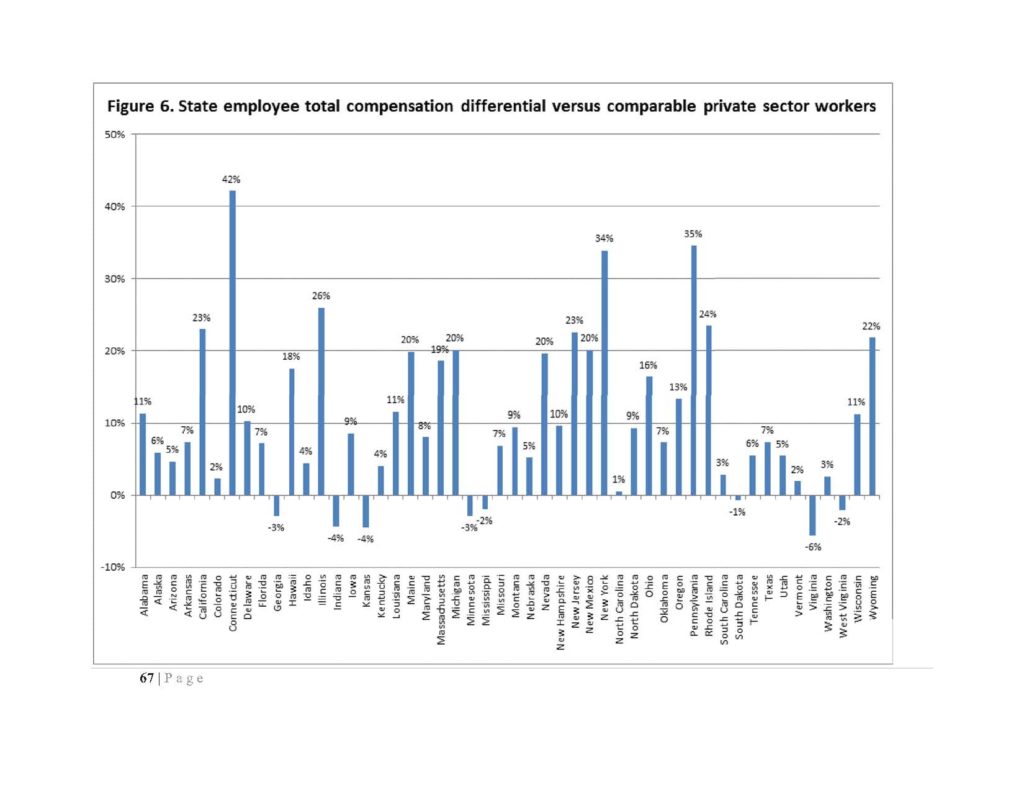

Jahncke: This is data based on data 2009 through 2012 from the Census Bureau, American Community Survey. The study was conducted in 2014, so it’s somewhat later than the 2010 state commission. Total compensation: Connecticut had the highest premium of state employee compensation relative private sector compensation. I will email this to you.

There is a more current study where Connecticut is not actually the highest in the nation but was amongst the highest. The as-of date of that study, also by the American Enterprise Institute, conducted in 2019, the most current available, they studied 2017 data. https://www.aei.org/research-products/working-paper/the-growth-of-salaries-and-benefits-in-the-federal-government-state-and-local-governments-and-public-education-1998-2017/

I would point out that 2017 is a year in the midst of the wage freeze, the longest wage freeze over the last decade for state employees and just before these two years we now have underway where there are 5% across-the-board average wage increases. So, it is not unlikely that Connecticut will reclaim the lead as the number one state with the highest compensation of state employees in the nation.

Representative O’Dea: Thank you very much for that information, for forwarding that to us. Thank you, Mr. Chairman.

Senator Leone: Thank you. Representative MacLachlan followed by Representative Farnen.

Representative MacLachlan (R-Westbrook, Clinton, Killingworth): Thank you, Mr. Chairman. I’ll make this brief. Late is the hour. Mr. Jahncke, thank you for your testimony. And your position is that a truck, a trucker’s only tolls, is not a viable solution to our infrastructure problems, a position that I agree with. Could you briefly expand on, and give us some bullet points, on an outline of how… why you think trucks-only tolls will not help solve our problems.

Jahncke: In the simplest form, it won’t raise the revenue that it’s projected to raise. I’m very skeptical, as a layman, that $230 billion will be generated each year from a 12-gantry system tolling only heavy trucks.

Representative MacLachlan: Understood. Thank you, sir. Thank you, Mr. Chairman.

Senator Leone: Thank you. Representative Farnen, followed by Senator Martin.

Representative Farnen (R-Fairfield): And I’ll be super quick too. So, if we did not go with the toll plan. We all agree that our infrastructure needs to be funded, it’s been underfunded, what would be the recommended path forward that you would want to choose. Would it be the Senate Republicans plan? Is it some alternate approach? How would you want to do it in a nutshell?

Jahncke: I think the governor should do what he said when he campaigned for office, which is to call Labor back to the table, reopen SEBAC and demand cuts in wages and benefits, and those cuts would fund transportation. Instead of looking for more revenue, let’s generate savings, and savings would finance transportation.

If we are in the crisis that I think everyone in this room acknowledges that we are – fiscally and financially and economically — why should we be paying our state employees the highest compensation in the country?

And even they should have an interest in re-negotiation, because their benefits are at risk. Instead of calling Labor back to the table, the governor instead has cut the state’s contribution to their retirement fund. He re-amortized it. [The state was to have contributed $1.77 billion in FY2019-2020; that’s been reduced to $1.62 billion.] He’s saving a billion over the next 10 years which is generating an additional $5 billion of cost over the following 20 years.

We won’t get to the 20 years. The state employee pension fund has $13.5 billion market value. Last year, it paid out 2 billion dollars in benefits. If, as [former] Governor Malloy said famously in 2017 or so, and has been reconfirmed by this administration, 33% to 40% of the state work force is going to retire before 2022, that 2 billion dollars is going to skyrocket overnight. We are going to start paying huge numbers in cash benefit payments, and that’s just the pension fund. That does not contemplate health care benefits expense costs which are skyrocketing every year for both actives and retirees.

So, I would submit to you that state employees really have an interest in re-negotiation and putting their pension fund on a more solid footing, because, if they don’t, the pension fund may very well go bankrupt. And, if the state attempts to save the pension fund in some way, the state may very well encounter a genuine financial emergency.

Representative Lemar: Thank you very much for your testimony here today. Senator Martin. Red, I’m sorry I forgot how to pronounce your last name.

Jahncke: I forget on Monday morning as I haven’t done it myself over the weekend. “Jankee.”

Representative Lemar: “Jankee.” Sorry. I thank you, Mr. Jahncke.

Jahncke: My pleasure.

Representative Lemar: Hold on a second. Senator Martin?

Senator Martin (R-31st Senate District): Hi. Thank you, Mr. Jahncke, for your testimony today. Could you just go over your percentages of the… your reduction of gantries. So, we originally started with 82 gantries and now we’re proposing 12. And I think that percentage was a reduction down to 29 percent, right?

Jahncke: I agree. Let me walk through it again.

Senator Martin: Thank you.

Jahncke: First of all, I didn’t use 82 gantries, because the point I would be making would be even more dramatic. I assumed that the government, governor, was… His original proposal was 50 gantries. So, if you reduce gantries from 50 to 12, 12 is 24% of the original system in terms of the collection, the collection points. If you reduce the traffic being tolled from 100% down to 5%, that’s trucks, the compound reduction — 5% times 24% — leaves you with 1.2% of the original. And how can 1.2% of the system to generate revenue, generate 29% of the 100% system.

Senator Martin: So, when you do the… you replace those percentages to dollars for the public here, what is that equivalent to?

Jahncke: Well, if you just did 1.2% [1.2% x $800 million = $9.6 million]. Now what needs to be recognized here is we’re not just reducing traffic over all. We are reducing [eliminating] vehicles that would be tolled at a much more modest toll rate [cars] and focusing only on vehicles [trucks] that are going to be assessed the highest toll rates. Nevertheless, that suggests very high rates on trucks, and, if you impose very high rates on trucks, you give them greater incentive to dodge the tolls. If they have to pay an arm and a leg through a gantry, and they only have to get off and drive one mile locally to dodge the gantry, they have… They’re businessmen. They’re gonna make the calculation as to whether it makes sense or not. They have Waze [or Google Maps] in their cab with them. They check the relative traffic on both the highway and the local roads. If they don’t lose too much time going local, they’ll go local to save the high rate that is being an imposed upon them.

Senator Martin: Thank you

Jahncke: Sure. Thank you.

Representative Lemar: Isee no other questions. Thank you, Mr. Jahncke, for your time.

Jahncke: Thank you to the Committee for granting me the time.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.