Location and Parking:

The Red Line

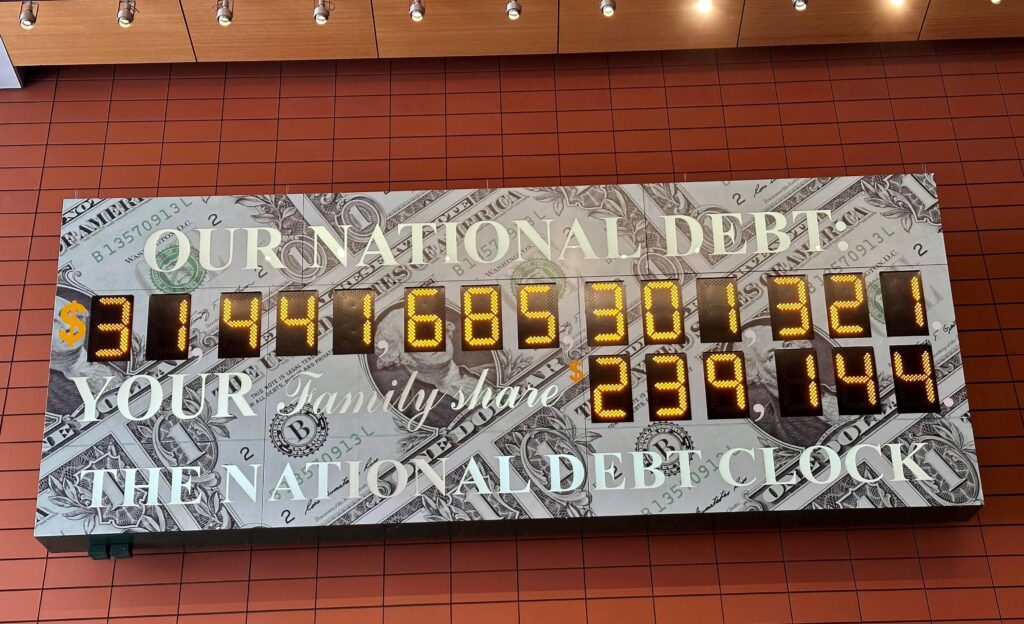

President Biden and House Speaker McCarthy delayed their meeting on the debt ceiling from Friday to Tuesday. Maybe there’s progress as aides “negotiate.” Yet, the debt ceiling crisis is but a symptom of a much more consequential debt crisis in the U.S.

It is not too much of an exaggeration to say that Biden’s massive spending imperils the nation, risking an eventual fatal default, not simply a temporary immediately-curable default. The debt ceiling has served a valuable function in forcing the nation to confront its unsustainable spending habit and its mountain of accumulated debt.

On May Day, Connecticut state budget masters wiped away $2.0 billion of expected tax revenue, without much notice.

May Day, May Day, we just lost $500 million annually over four years in a state with an annual general fund budget of just over $20 billion. That was not the general reaction, though it should have been.

The Nutmeg State cannot afford the sudden loss of $500 million per year, as projected in the new official state tax revenue forecast, jointly released Monday by the Office of Policy and Management and the Office of Fiscal Analysis.

The debt ceiling standoff between President Biden and House Republicans has reached a moment of truth. Yesterday, suddenly and belatedly, Treasury Secretary Yellen warned that June 1 could be the “X date.”

That’s the date on which our Treasury can no longer employ “extraordinary measures” to keep the nation’s debt below the current ceiling and avoid default. Why is the deadline so much sooner than expected?

April tax receipts came in far below expectations, and Uncle Sam has been spending more and more money every month.

President Biden and Speaker McCarthy are running out of time. That’s what the numbers are telling us in the months since January, when the Treasury said it could employ “extraordinary measures” to remain under the ceiling for five months.

The most important “measure” is income tax collections. They look likely to fall significantly short of Washington’s expectations this filing season, dragged down by plunging receipts from capital gains taxes.

Capital gains taxes are likely to come in below the Congressional Budget Office projection of $315 billion for the full fiscal year of 2023. CBO’s forecast is down only $63 billion, or 17%, from last fiscal year’s record high of $378 billion that was produced by the eye-popping rise in stocks of 27 percent in 2021, as measured by the S&P Index .

Such a modest decline seems unlikely given that the stock market in 2022 had a dramatic reversal of fortune and plunged almost 20%. That’s a greater annual decline than in any year since 2008, when the S&P plunged 38% and capital gains taxes fell about 50% the next fiscal year, according to CBO.

April is tax season, as taxpayers are painfully aware. Every year a large proportion of individual income taxes are paid in April. But, depending upon the economy and stock market, April tax payments vary significantly year to year and their composition even more so.

In April 2019, individuals across the land paid $397 billion in income taxes. Of that, $263 billion were “other” taxes, namely taxes on non-wage income. Three year later, in April 2022, individuals paid $642 billion, of which a whopping $515 billion were other taxes, mostly from stock market gains.

The hundred-billion dollar question in Washington these days is how much will arrive this month.

Following the national pattern, the one-billion dollar question in Hartford is how much will arrive this month.

Connecticut tax revenue is likely to plunge in the last four months of the current fiscal year, taking annual tax revenue down about $1.1 billion below the official forecast, according to a new study by The Townsend Group which I head.

That’s a big miss in a state with total annual tax revenue of about $22 billion. It is a huge miss, given that we already know how much taxes have been collected for two-thirds of the year.

The miss relates exclusively to tax revenue derived largely from investment activities.

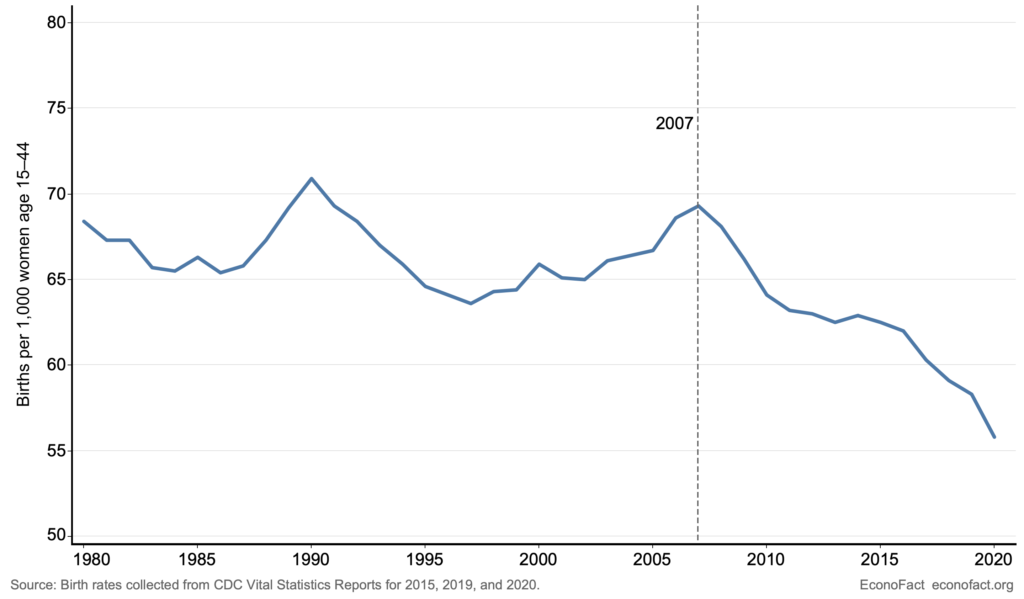

The most consequential change in the role of women is getting scant attention during Women's History Month.

A rising percent of women in the developed world do not intend to have children. In a 2021 survey by PEW Research, 44% of childless U.S. adults of childbearing age said they were “not too likely or not at all likely” to have children, up from 37% in 2018. These are alarming numbers. They cry out for follow-up research.

Are they a temporary hangover of the pandemic, during which births actually increased among the college-educated according to other research, or an acceleration of ongoing trends, some good but most not so much?

So, why don’t childless U.S. adults want to have kids?

Almost two months ago, we reached the ceiling on the national debt. On its natural course, the debt would have blasted through the $31.38 trillion ceiling. So, the Treasury Department began implementing “extraordinary measures” to avoid breaching the limit. Treasury estimated that it could keep the debt under the cap for roughly five months.

Congressional Republicans say there must be a plan to cut the massive deficit spending which has fueled the recent rapid escalation of national debt.

The so-called responsible faction in the debt ceiling debate says that the ceiling should be raised without any preconditions -- without any risk of default.

There’s a group of about 20 House Republicans—who originally opposed Kevin McCarthy’s speakership—who have announced their adamant opposition to raising the ceiling without meaningful spending cuts.

In turn, the responsible faction has reared up in indignation and labelled this small faction irresponsible and worse.

But who’s really irresponsible?

This small group or the Biden administration and congressional Democrats, who have been borrowing and spending massive amounts for two years.

Two weeks ago, the lead editorial in The Wall Street Journal compared New York State and Florida “by the numbers” in an exercise The Journal described as “comparative governance.”

The exercise merits emulation. So, let’s add “the numbers” for the Nutmeg State alongside those that the Journal displayed for the Sunshine State and the Empire State. To The Journal’s chosen metrics, I have added just a few, without which the number set would not capture the fiscal reality of Connecticut.

Now let’s compare Connecticut to New York. Forget a comparison with Florida.