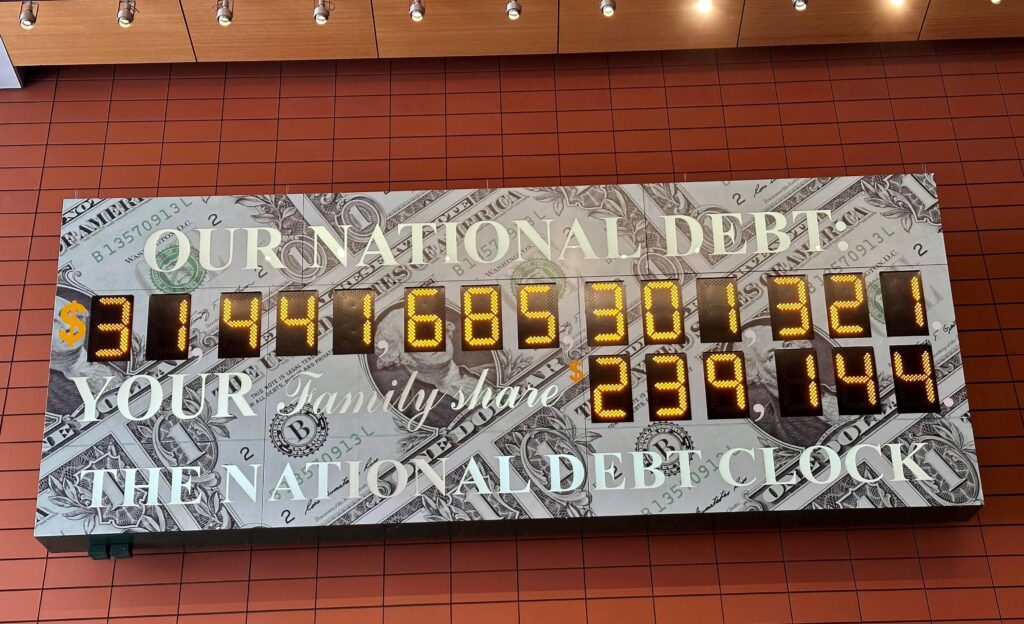

Almost two months ago, we reached the ceiling on the national debt. On its natural course, the debt would have blasted through the $31.38 trillion ceiling. So, the Treasury Department began implementing “extraordinary measures” to avoid breaching the limit. Treasury estimated that it could keep the debt under the cap for roughly five months.

Congressional Republicans say there must be a plan to cut the massive deficit spending which has fueled the recent rapid escalation of national debt.

The so-called responsible faction in the debt ceiling debate says that the ceiling should be raised without any preconditions -- without any risk of default.

There’s a group of about 20 House Republicans—who originally opposed Kevin McCarthy’s speakership—who have announced their adamant opposition to raising the ceiling without meaningful spending cuts.

In turn, the responsible faction has reared up in indignation and labelled this small faction irresponsible and worse.

But who’s really irresponsible?

This small group or the Biden administration and congressional Democrats, who have been borrowing and spending massive amounts for two years.