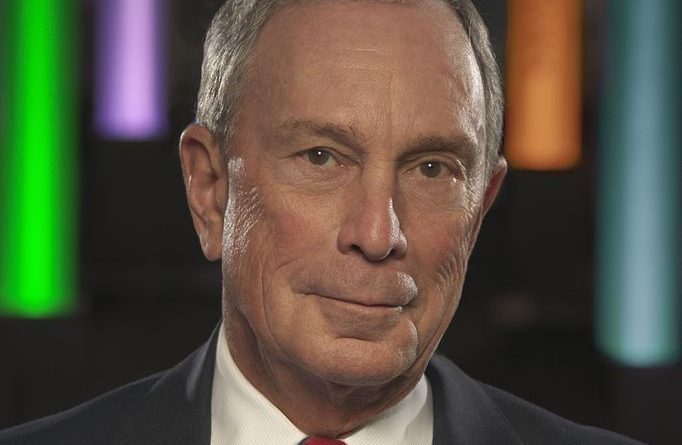

Michael Bloomberg’s entry into the presidential race about a week ago was panned almost universally. Political pundits dismissed his bid, many with trite “truisms” about political tradecraft. First, that money can’t buy the presidency. Second, that his late entry is fatal. Third, that by skipping the first four contests, he will fall hopelessly behind. Fourth, his policy stands are all over the map, so he has no natural following or base.

But maybe Bloomberg has a strategy. After all, if he’s so dumb, why’s he so rich? Let’s hazard some thoughts on possible strategy. Maybe Bloomberg is crazy like a fox.

First, let’s be realistic, his $50 billion provides him a tremendous advantage.

Second, pundits have deemed his late entry to be fatal, as if late entry alone were as fatal as stage four pancreatic cancer. What has passed as analysis has been limited to references to the failure of other late entrants. Yet, none of the referenced candidates had Bloomberg’s money, and virtually all failed for reasons other than late entry — and the same reasons have felled early entrants.

In 2016, late entrant Rick Perry was felled by momentary brain freeze about the third in his trademark list of three federal agencies he’d shutter. However, the earliest entrant in the 1968 contest, George Romney, was eliminated well into his campaign by just one word, “brainwashed,” and in 1972 another early contender, Ed Muskie, by a single sob on the campaign trail just days before the New Hampshire primary.

Third, skipping the first four contests has an obvious and compelling rationale. To flip a popular saying: You can’t lose it if you’re not in it. This is a variant of the successful strategy of American revolutionaries: They ran away to fight another day. Bloomberg will survive the first four contests. Every other candidate, except four at most, won’t.

There are virtually no delegates at stake in these early contests — just 4 percent of the total. The winner(s) of those contests will have virtually nothing to show for the enormous effort entailed, except bragging rights, which then must be defended in the next of the four contests to meet elevated expectations and to maintain momentum.

Bloomberg won’t have lost any meaningful ground, unless one candidate rolls the table, winning all four early contests. What are the odds of that? South Bend, Ind., Mayor Pete Buttigieg has surged into the lead in Iowa and New Hampshire, but is mired in single digits in the following contest in South Carolina, where former vice president Joe Biden holds a commanding 19-point lead.

If Bloomberg hasn’t lost anything, what has he gained by skipping the first four contests? Here it gets interesting.