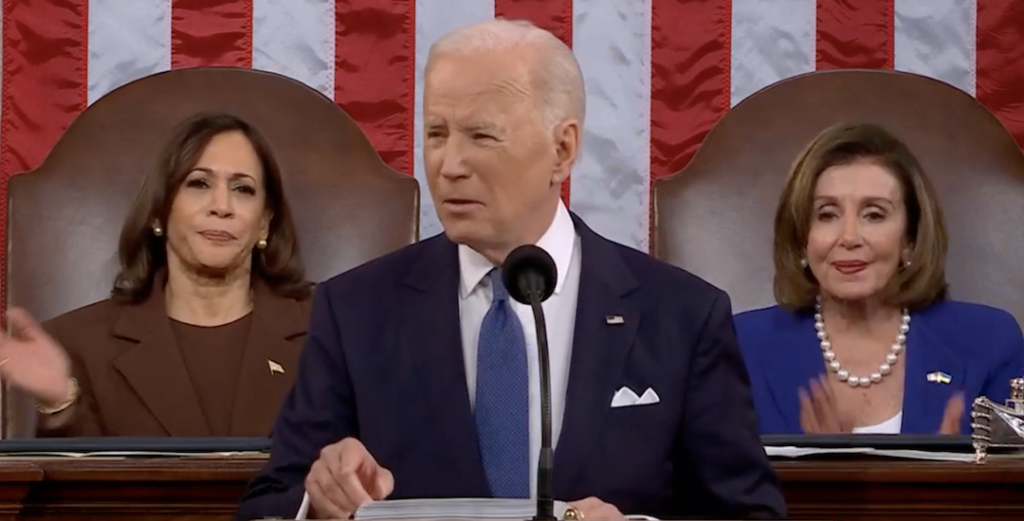

Biden Administration generals are fighting the last war. Last Thursday, they mandated that large businesses and health care facilities require that their workers get vaccinated for COVID-19.

The next day, Pfizer announced an antiviral pill to treat the virus. Pfizer’s pill is 89% effective. A Merck antiviral pill for COVID-19 (with only about 50% effectiveness) is already in use in Britain.

COVID-19 treatment pills destroy any vestige of logic or justification for Biden’s vaccine mandates.

No matter how someone contracts the virus, these pills prevent serious illness – hospitalization and death. With double lines of defense against the coronavirus – vaccination, and, now, these new antiviral treatment pills – mandates have become unnecessary.

Last Saturday, the Fifth U.S. Court of Appeals issued an emergency stay of the Biden business mandate, saying it raises “grave statutory and constitutional issues.”

Quite apart from the legal issues, the mandates ignore science and logic. The logic of vaccine mandates has always been weak and self-contradictory insofar as their implied purpose of protecting vaccinated people from unvaccinated people. If vaccines are effective (95% effective in Pfizer’s case), then, vaccinated people face little risk from unvaccinated people.

If the vaccines are ineffective, then why should anyone get them?