Connecticut Democrats are delusional. They clamor that democracy is under assault by Donald Trump and hold statewide “No Kings” rallies; then, they host a completely undemocratic special legislative session and anoint Ned Lamont King.

The Democrats’ recent one-day emergency session of the General Assembly suspended genuine democratic processes followed in regular sessions – committee hearings, presentations by executive branch officials and public testimony. An emergency session is supposed to deal with a truly unforeseen emergency, yet this session dealt with the long-running issues of housing, the drawn-out state takeover of failing Waterbury Hospital and the long-anticipated reversion of federal assistance to pre-COVID levels.

The normalization of federal assistance levels is only in prospect, yet the Democrats gave Governor Lamont a half billion dollars to meet the challenge and spend however he sees fit. If that is not granting unilateral power to a new King, what is?

All of this could have awaited the regular session less than two months away.

Had there been hearings, someone could have pointed out that Donald Trump has probably already solved Connecticut’s housing crisis. A housing availability and affordability crisis can only exist when demand exceeds supply. At the most fundamental level, growth in demand for housing can only come from population growth.

According to the Census Bureau, population growth in Connecticut has been non-existent, except for illegal immigration. 95,000 foreign-born immigrants have come to the state over the most recent four-year period for which data is available (while 24,000 citizens left the state). Natural growth has been zero, with births equaling deaths at 147,000.

Joe Biden’s open-border policy fueled foreign in-migration. Now, Donald Trump has closed the border, so the tide in Connecticut will reverse, swinging to population shrinkage based on outmigration of the 24,000 citizens. Logically, housing demand will decline, solving any housing crisis.

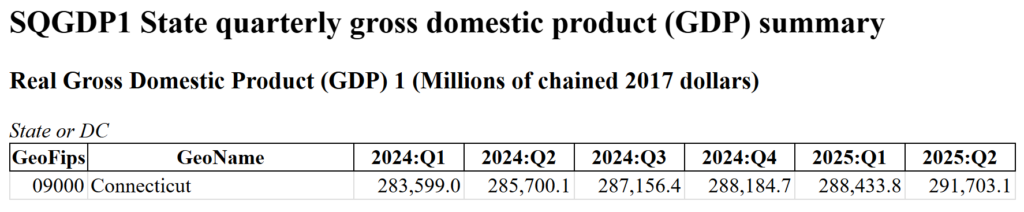

Make no mistake, citizens will continue to leave. Why? Because the state’s economy is not growing. According to the Bureau of Economic Analysis, the state’s real economy grew at an anemic compound annual rate of 0.8% over the five-year period from 2019 to 2024; it grew only $2.9 billion, or 1.0%, from $283 billion in 2023 to $286 billion in 2024.

It was flat at $288 billion from the fourth quarter of 2024 through the first quarter of this year, only catching up and returning to trend with a $3 billion spurt in the second quarter.

Likely, the housing bill that super-majority Democrats rammed through the one-day special session will prove unnecessary, if not unworkable and harmful.

On to the next big special session item, King Ned’s half-billion-dollar slush fund to cushion the return of federal assistance to normal pre-COVID levels. That half-billion had to be taken from somewhere.

A recent article in CT Mirror fingers the source, i.e. the Volatility Cap, which sends money to the Rainy Day Fund, whose overflow is deposited into state pension funds. The article (since updated with the removal of the following quote) seemed to imply that enough money has gone that way, and, therefore, that it is OK to divert money to King Ned: “Connecticut has used more than $10 billion in surplus to whittle down its considerable pension debt since 2020, on top of the more than $3 billion in required pension contributions it makes annually through the budget.”

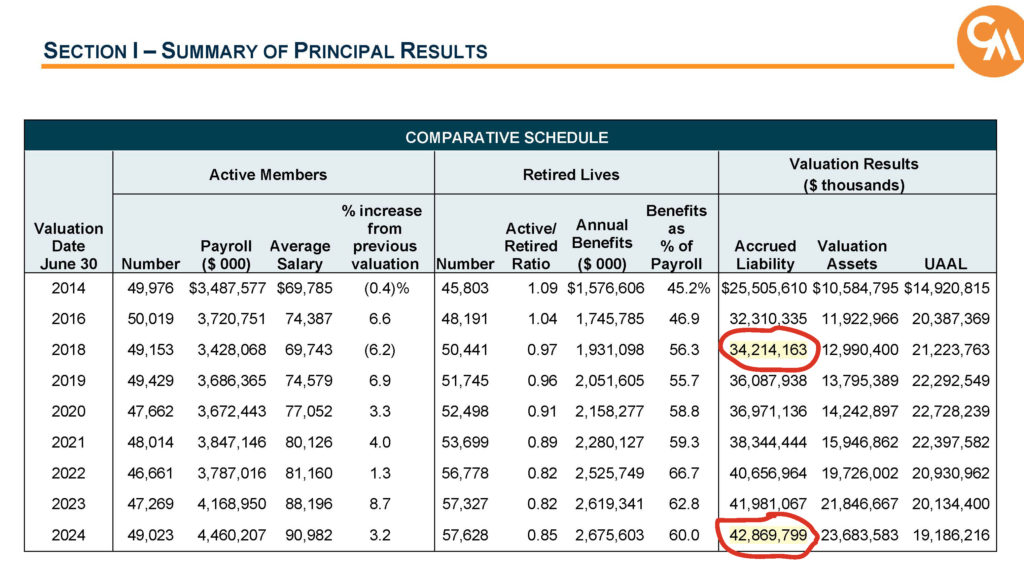

The Mirror quantified the money going into pensions – some $25 billion – but did not quantify the “whittling down.” Why? Because there’s been little “whittling.”

Pensions are based on wages. When wages escalate, so do pensions. Lamont has given state employees six consecutive annual wage increases cumulating to 33% (vs. 23% in the private sector and 25% inflation). A state employee making $100,000 on Lamont’s first inauguration day is making $133,000 today. New pensions are now being calculated on the basis of pay levels that are 33% higher.

Soaring wages have produced a staggering $9 billion increase in the aggregate future obligations of the SERS pension fund as of June 2024. With all the “surplus deposits” and regular annual contributions, SERS’ pension assets have grown only $11 billion, resulting in only a $2 billion reduction in net pension debt. Not much “whittling.”

If those huge “surplus deposits” have only achieved such meager pension progress, they are not “surplus” at all, but rather critically needed pension funding. So, Ned’s fund should be unfunded, and the “surplus deposits” reinstated.

A new pension report through fiscal 2025 is due imminently from pension actuaries.

Even with “surplus deposits” restored, if robust wage increases continue, then progress will still be only meager. With time to deliberate in a regular session, Democrats should realize this and freeze state employee wages, just as Democrat Dannel Malloy did three times during his time as governor.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.