The Merriam Webster dictionary defines sophistry or sophism as “an argument apparently correct in form but actually invalid.”

This definition describes perfectly a recent newspaper headline that ran in several Connecticut newspapers in mid-September reading “CT on pace for another multibillion-dollar budget surplus.”

The subtitle got specific: “Early projections from Gov. Lamont put state nearly $2.3 billion in the black this fiscal year.”

Certainly, the headline implied the “multibillion-dollar budget surplus” was a marvelous new development.

It wasn’t and isn’t. The surplus was forecast in early May when the official state budget was enacted.

The newspapers knew, or should have known, this.

The pretext for the headline and article was a legally required monthly letter sent by Jeffery Beckham, Secretary of the Office of Policy and Management (OPM), to the State Comptroller assessing actual performance versus budget forecast for the first two months of the new fiscal year. Beckham reported a slight improvement of $145 million in revenue.

A $145 million deviation in the $22 billion General Fund budget is a variance of less than 1%, hardly warranting news coverage.

The “$2.3 billion surplus” was only a slight upward revision of $145 million to the $2.15 surplus that was forecast in the budget adopted in May.

Such a slight adjustment is not news.

What should be news is the now-questionable nature of the largest part of the $2.15 billion surplus forecast last May, namely the $1.8 billion “Volatility Cap Deposit” – note the word “volatility.”

The “Deposit” derives from taxes on non-wage or investment income of higher income and wealthy individuals that come predominantly from stock market gains.

Well, the stock market has plunged since early May, not exactly promising circumstances for anyone to achieve market gains. All three major stock indices are down over 20% year to date. Since May 3rd, the date of budget’s enactment, the DOW is down 12%, the S&P is down 13% and NASDAQ is down 15% (and 32% for the year).

Yet, the official estimate for this type of revenue has not budged since May. Specifically, the official forecast of income tax revenue from “estimate and finals” (E&F) plus the “pass through entity tax” (PET) is $5.48 billion today, exactly the same amount as forecast in the budget in May, according to Mr. Beckham’s letter,

There is a bureaucratic excuse for this. By state law, the official revenue forecast must be agreed by OPM and the Office of Fiscal Analysis (OFA) in the legislative branch. The next “Consensus Revenue Forecast” is not scheduled to be issued until mid-November. Mr. Beckham cannot unilaterally alter the forecast.

The newspapers knew, or should have known, this.

The purpose of the Volatility Cap is to save some of the fat in fat years to cushion the pain in lean years. “Fat,” in budget terms, is income tax revenue from investment income, which, obviously, is highly volatile.

The official budget adopted in May anticipated some of this year’s reversal of fortune in the stock market. It assumed a 16% decline in E&F and PET, or “non-withheld,” income tax revenue. Is that adequate for more than a 20% market decline? Doubtful.

What if the S&P repeats its 2007-2008 experience, plummeting 52% from high to low? Indeed, if history repeats, then E&F and PET tax revenue could decline 75%, as capital gains tax revenue did at the federal level from 2007 to 2009. If that history repeats, there will be no Volatility Cap Deposit and no surplus at all.

This is the issue that the article should have addressed.

Not only is investment income volatile, but most of it is only reported and paid with final tax returns in April, which means that budget-vs-actual comparisons beforehand are not very reliable.

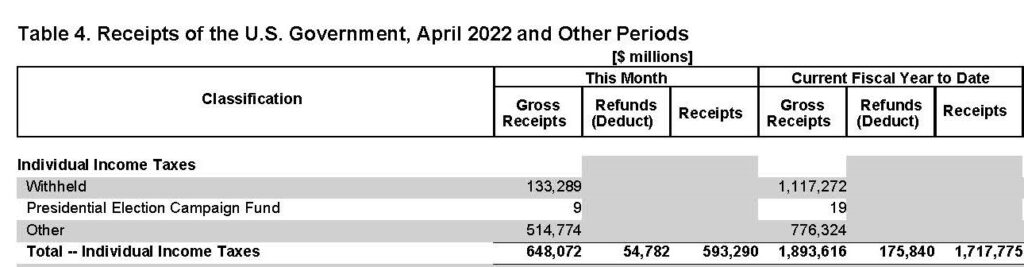

For example, at the federal level, for tax year 2021, $515 billion of non-withheld individual income taxes were paid in April 2022, according to the Monthly Treasury Statement for April. Over the nine months beforehand from July through March, only about $398 billion was paid, primarily with required estimated quarterly filings in September and January.

In July and August – the season covered by Mr. Beckham’s letter, only about $30 billion of non-withheld individual income taxes were paid to the IRS in both 2021 and 2022, reflecting that there are no quarterly estimated tax filings required in these two months.

In good years and bad, there is no meaningful data in these two months to project full year results.

Instead of recognizing this reality, the article doubled down on a stale official budget forecast, portraying it as if it were a new up-to-date estimate. This was unprofessional and wildly misleading.

One partial cure for this kind of journalistic mischief is to require a Consensus Revenue Forecast in mid-October, which would capture the revenue paid on the September 15 quarterly tax filing date at the federal and state level.

The state’s readers, citizens and voters deserve better from journalists than election year puff pieces mischaracterizing facts to portray a rosy picture about the incumbent governor’s seemingly marvelous fiscal performance.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.