[Editor's note: In the 2019 legislative session, a bill (House Bill 6935) virtually identical to the one discussed in this news report (House Bill 5270) passed the Labor and Public Employees committee but was not passed by the General Assembly. See: NOT ALL WORKERS FOOLED BY UNION SCHEMES AND PROPAGANDA here on The Red Line]

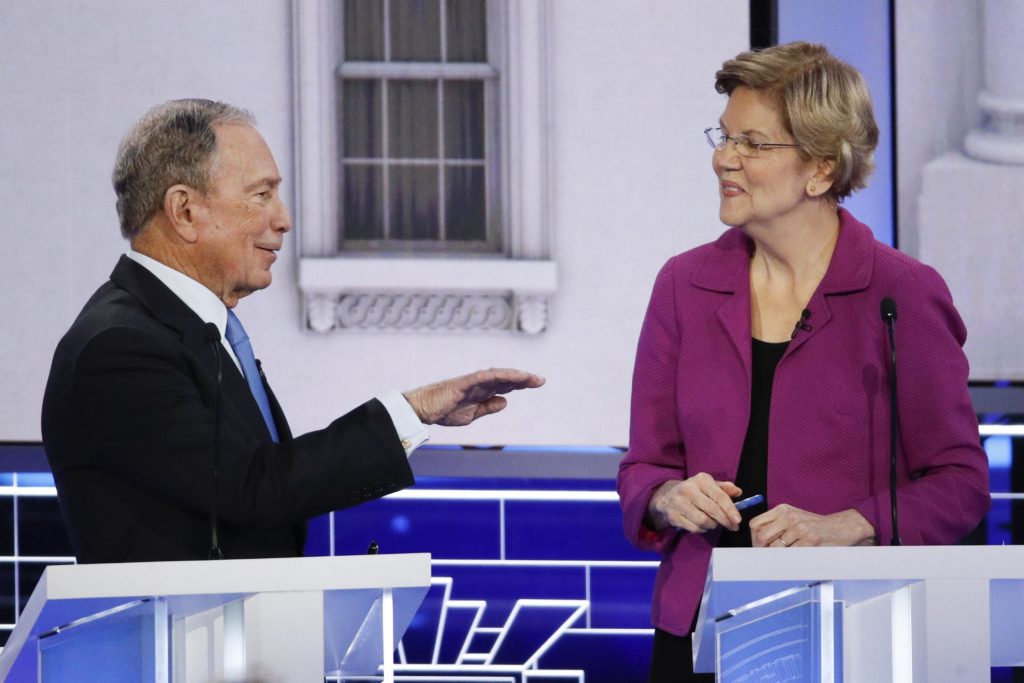

HARTFORD – Public employee unions are seeking to expand recruitment opportunities while claiming membership has hardly declined since a U.S. Supreme Court ruling freed workers from having to pay for union representation.

Organized labor is backing a bill before the Labor and Public Employees Committee that proposes to increase the access state and municipal employee unions have to new hires and their personal information.

The legislation is a response to the U.S. Supreme Court’s 2018 ruling in Janus v. AFSCME that overturned a 41-year-old precedent that had allowed states to require that government workers who decline union membership to pay some union fees.

A coming wave of retirements is also giving state employee unions reason to want to guarantee wider access to new hires.

Some 15,000 state workers are eligible to retire before costly pension changes concerning cost-of-living adjustments and health care contributions take effect on July 1, 2022. This is one-quarter of today’s state workforce. The Lamont administration is only expecting 5,000 to 10,000 retirements, though.

Approximately 46,000 state employees had union dues deducted from their paychecks for the most recent pay period, according to the Office of the State Comptroller. This was two-thirds of all employees.

THE PROVISIONS of House Bill 5270 would entitle public employee unions to the name, job title, department, work location, work telephone number and, subject to confidentiality exemptions, the home address of any newly hired employee.

Starting in 2021, a public employer would also be required to provide unions this personal information for all members of a bargaining unit at least four times a year unless an employee opts out in writing.