Six months ago, I authored a column about the fiscal condition of Connecticut, focusing on a table of statistics which The Wall Street Journal had used to compare New York and Florida.

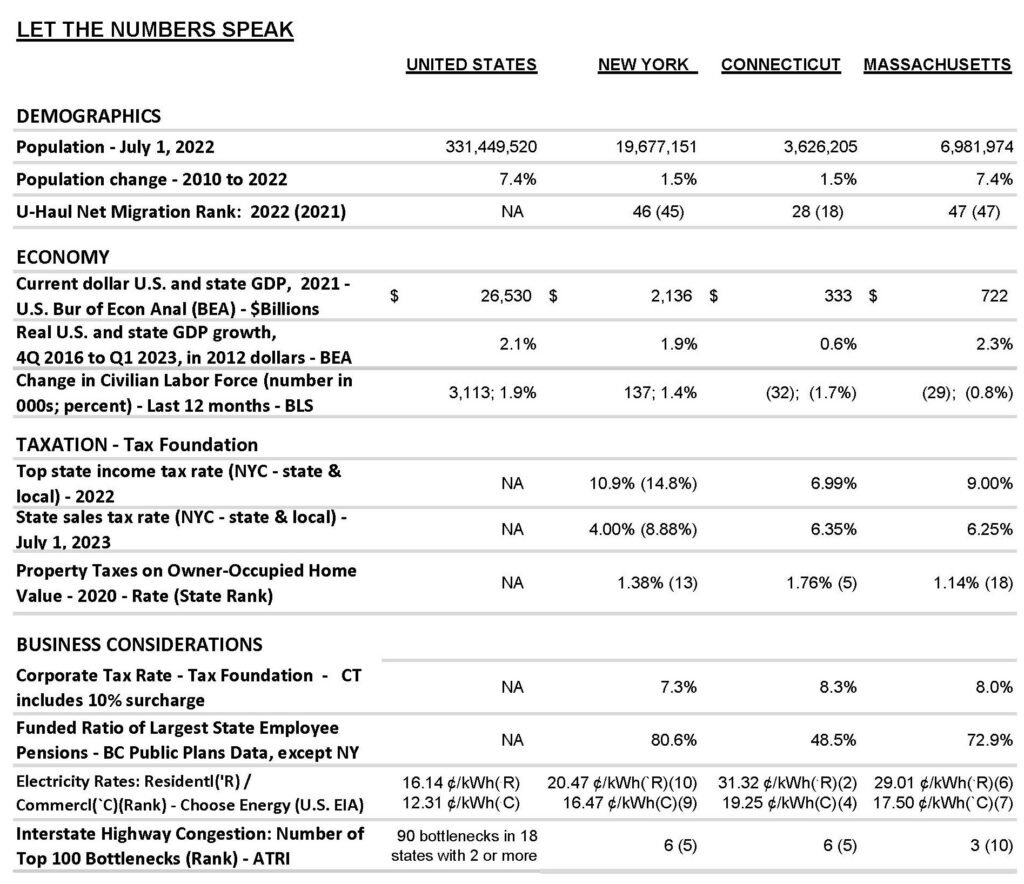

In this updated edition, the table compares Connecticut to its two big neighbors, New York and Massachusetts, and to the entire nation. In addition, the table is reorganized into sections covering demographics, the economy, taxation and factors important to businesses in choosing operating locations. These are the most important dimensions to measure the vitality of a state.

Demographics: The populations of Connecticut and New York are barely growing. While Connecticut enjoyed a short burst of net in-migration – mainly from New York driven by the pandemic, that appears to have reversed in data from CT Data (which does not appear in the table, because there is no such data for the comparison states). The decline is confirmed by the fall in Connecticut’s U-Haul ranking (ratio of incoming vs outgoing moving vans). Massachusetts seems an anomaly likely based upon college students coming and going.

Economy: Connecticut’s economy is small and barely growing, and the labor force is shrinking.

Taxation: Relative to neighbors, Connecticut is a haven for high income individual taxpayers, about equivalent insofar as sales tax is concerned and an onerous place to own a home.

Business (Re)location: On business location decisions, Connecticut is uncompetitive, even regionally. Electricity costs are twice the national average, and the highest in the region. Traffic congestion is awful in the entire Western (populous) half of the state. The corporate tax rate (at least for large companies) is high, with the never-ending extension of the 10% surcharge.

Though progress has been made on unfunded obligations, courtesy of massive federal COVID assistance and a long boom in the stock market, the state employee pension fund remains among the lowest funded in the nation; and that is not to mention a roughly equal dollar amount of retiree health care benefits which are almost entirely unfunded. As is well known, business and individual taxpayers do not want to be liable for the almost inevitable tax increase that will eventually be required to meet these obligations. Legendary business investor Warren Buffet has said that he would not invest in a state with large unfunded public pension obligations. A future reprise of this column will include numbers about the state budget, including the various forms of health care spending which claim an above average share of spending.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.