What happened to Connecticut Governor Lamont’s “debt diet”… if there ever was one?

Lamont is running for reelection claiming credit for fiscal restraint.

Yet, since Ned Lamont took office, Connecticut’s long-term borrowing has increased from about $25 billion to $27 billion. Moreover, after issuing $1.2 billion of new bonds already this year (see below), the state is officially scheduled to issue another $1.3 billion of new bonds this fall. In addition, Lamont and crew have committed to issue $175 million of Community Investment Fund bonds as well.

What kind of diet is that?

Lamont’s claim of engineering a fiscal turnaround of the state couldn’t be further from the truth. That is not necessarily to say that he has mismanaged affairs, but rather to say that he has had virtually nothing to do with the factors which have improved the state’s standing… improvement which will only be temporary.

Three factors have been at play. The federal government has showered the state with Covid assistance money; the roaring bull market in stocks and bonds through December 2021 has produced a gusher of tax revenue from the state’s large population of wealthy investors; and, finally, automatic fiscal restraints adopted in 2017 before Lamont took office have limited spending.

Lamont was simply lucky at being there as governor as the three trends coincided.

No one should begrudge him his good luck.

Yet, these trends have now reversed, as everyone knew they would eventually.

Likely, Lamont embellished his good-luck story with his “debt diet” fable to claim personal credit for the fiscal improvement. If he had genuinely understood and embraced the reality that Connecticut’s and his good fortune would eventually run out, he would have enforced a real debt diet.

Instead of taking real action, Lamont perpetuated his fable and, indeed, enhanced it in the details of the budget that he and his fellow Democrats adopted just last May. Naturally, debt must be serviced, with interest payments and principal repayments on due dates. Despite the growth in the state debt, debt service has barely increased due to the abnormally low interest rates over the past several years. Over the last five years, aggregate annual interest paid has been between $1.1 billion and $1.2 billion, or essentially flat, according to Annual Reports of the State Treasurer.

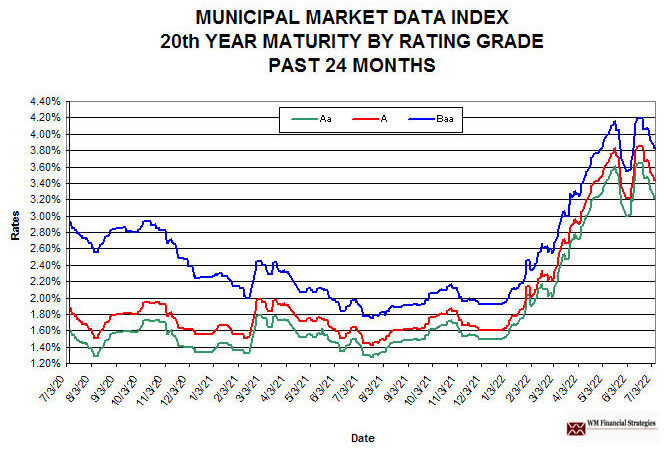

The interest rate outlook has changed dramatically in 2022, as was readily apparent in May of this year when the budget was adopted. Yet, the Governor and the Legislature agreed, as set forth in the budget for State Treasurer, that “Future debt service growth is expected to be limited due to three factors: 1.) improved market borrowing rates…” Really?

In December of 2021, the state issued $800 million of General Obligation (GO) bonds at a 1.98% borrowing cost. Last March, the State issued about $200 million of GOs at a 3.23% cost, and, in May, another $1.0 billion at a 3.68% rate.

In less than six months, the state borrowing rate almost doubled. That’s “improved market borrowing rates?”

And that’s without factoring in the Federal Reserve Board’s subsequent 0.75% interest rate increase in June and its inevitable 0.75% increase in late July, after this week’s announcement that inflation hit 9.1% in June.

Adopting a budget based upon “improved rates” is not just painting a rosy picture; it is promoting a deceptive and misleading narrative.

In fact, the Democrats lowballed the overall debt service cost for fiscal year 2023 even relative to the original appropriation for 2023 made in 2021 in a wholly different interest rate environment. The original 2021 appropriation for 2023 was $3.44 billion. The new appropriation set in May 2022 was $28 million lower, despite the much higher interest rate environment.

This borders on budgeting malpractice.

This is not just misrepresentation in terms of lowballing interest costs. Undoubtedly, the state will lose hundreds of millions of income tax revenue from its wealthy investors who are now taking big losses in the markets.

It is a certainty that the federal Covid assistance money will run out. Indeed, the $2.8 billion of American Rescue Plan money is budgeted to be spent by the end of the current fiscal year. By federal law it must be spent by the end of calendar 2024.

If, as appears highly likely, the economy slips into recession in the near term, other revenue will dry up.

Yes, the state has a robust “rainy day fund,” or Budget Reserve, of about $3.6 billion. But that money can disappear quickly with the reversal of the three powerful trends which generated it in the first place, especially if even more money is needed to meet much higher debt service requirements than Lamont and Democrats are projecting.

Then what? Spending cuts triggered by the 2017 automatic fiscal restraints? More probably, tax increases, so Democrats can evade the 2017 restraints and continue to spend.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.