Connecticut is in a full-blown jobs crisis.

The state workforce has shrunk by about 160,000, or 8.2%, from its pre-pandemic level of 1.93 million in February 2020, the worst decline in the nation. Only three other states have experienced drops of more than 5%.

Of Connecticut’s remaining workforce, about 140,000, or 7.9%, are unemployed – the highest unemployment rate of the 50 states.

Combined, 300,000 people, or 15.5% of the pre-pandemic workforce, have dropped out or are currently unemployed. The next worst level is 10.9% in Hawaii.

Being last is something that Connecticut is accustomed to, but to trail 49th place by such a huge margin is alarming.

- Related Content: CRT is Divisive and No Cure; Jobs Are the Top Priority

- Related Content: CT Employment Has Plummeted. Can It Recover?

Yet, the Democrats who control the state seem clueless. Governor Lamont was mum about last week’s report of just 3,500 jobs gained in June. The gains occurred entirely in the public sector. Private sector jobs declined.

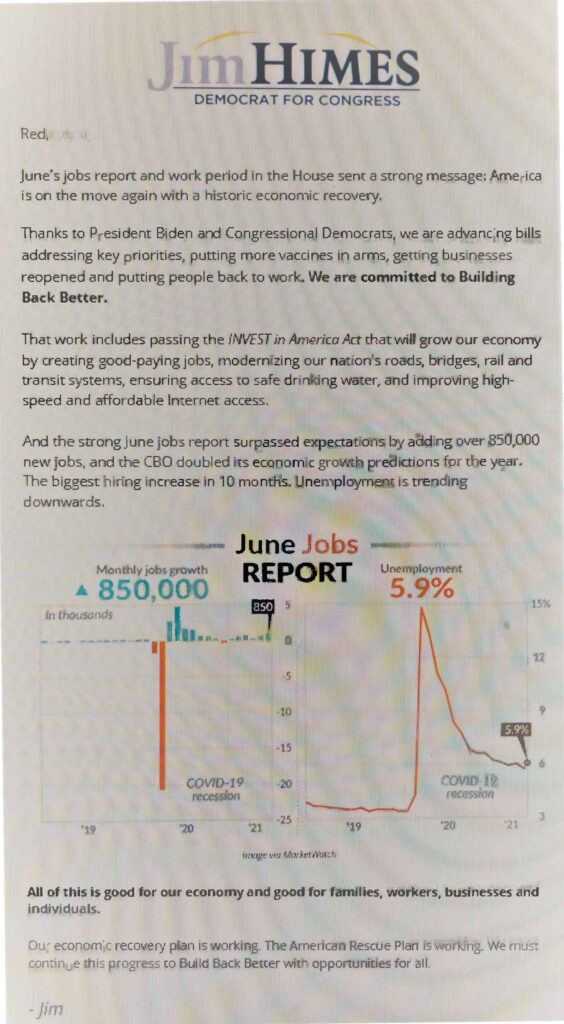

The state’s Congressional delegation is oblivious as well. Congressman Jim Himes (D, 4th District) sent an email to constituents last week trumpeting that “the strong June [national] jobs report surpassed expectations by adding 850,000 new jobs.” He included graphs of the national trends. He made no mention — and, likely, had no knowledge — of the dismal conditions in Connecticut.

Let’s parse the numbers — first by looking at the difference between being officially unemployed and being no longer part of the official workforce. If you are receiving unemployment benefits, you are officially an unemployed member of the workforce. If you have no job, but are not collecting unemployment, you are no longer part of the workforce.

Normally, to qualify for benefits, you must be looking for a job. However, during COVID, that requirement was waived.

Why would anyone pass up free money, i.e. unemployment benefits without any strings attached? Unemployment benefits eligibility during COVID was expanded to cover so-called “gig workers,” i.e. the self-employed and independent contractors, so virtually everyone could receive benefits simply by filling out forms. Why would anyone pass up rich benefits that include the super-generous federal supplement of $300 weekly ($15,600 per year) on top of normal benefits?

There would not seem to be any rational reason not to collect unemployment… except one: you think your future is brighter in another state. By this logic, there’s a strong possibility that many, if not most, of the 160,000 drop-outs from Connecticut’s workforce have left the Nutmeg State for greener pastures.

While Census Bureau data for 2020 interstate migration is not yet available, United Van Lines, the nation’s largest moving company, has published its 2020 moving data. It shows Connecticut with the fourth highest outmigration, with outbound moves almost twice the number of inbound moves. So much for the fantasy that an exodus from New York City will rescue the state.

Most economists believe that overgenerous unemployment benefits are hindering job growth, with many workers calculating that they can take more home in unemployment benefits than they can earn in the workplace.

Earlier this spring, other reasons were cited. Those reasons have faded. If childcare was a problem with schools closed during the school year, it cannot be a problem in summer when schools are always closed.

Lingering concerns about COVID cannot be determinative given the nation’s high vaccination rate. 68% of citizens over 18 have had at least one shot. Actually, job growth has been higher in states with lower vaccination rates. That’s a good economic development, despite the public health concerns.

The case is compelling that Connecticut’s jobs crisis is a function of two dynamics: (1) overgenerous unemployment benefits and (2) outmigration.

Lamont should terminate the $300 weekly federal supplement, as 22 states did in June. In June, workforces in those 22 states averaged less than 1% below pre-pandemic levels versus 2.4% below for the 24 states planning to pay the $300 until it expires in September. Average unemployment in the 22 was 4.3% versus 5.9% in the 24. Three more states have ended the supplement this month and another will on August 3rd.

Outmigration is a long-term problem with no quick fix — nor any fix at all without addressing its underlying cause. In the short term, the overgenerous $300 supplement is making the problem worse. Businesses cannot find workers. As a result, some will close, and some will move out of state (if they can).

That will mean fewer jobs available when the supplement expires. So, some workers will not be able to find jobs. They will suffer… or move out of state. Inexorably, the state economy will continue its long-term stagnation – over the decade before to the pandemic, it gained only about 5,000 jobs — or actually shrink.

Surviving business and individual taxpayers will face even bigger tax bills to pay to a state government bureaucracy that, in contrast, never seems to shrink, courtesy of the state employees’ decade-long contractual no-layoff guarantee.

Moreover, the state bureaucracy has been richly overcompensating its employees, whose average pay has increased 11.5% over the last 25 months, due to two successive mid-year 3.5% pay raises plus two automatic annual “step” wage increases averaging about 2%.

This increase is so rich that some union members have been earning more than their non-union bosses, to whom, therefore, Democrats just gave equivalent raises.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.