It may not exactly be breaking news, but it turns out that people would rather have a job than a tax hike. In fact, it turns out, people would rather have a job than voting for tax hikes on other people.

It also turns out that even limousine liberals — not all of them, mind you, but most of them — prefer a growing economy to redistributing income. It does my heart good. Metropolitans of both coasts actually prefer a growing economy to redistributing income.

They like their limos. They don’t want to hand them over. Except for a few, like Gates or Buffett, our progressive friends really don’t want to pay higher taxes.

The good folks, the middle income blue collar working people who drive F-150s, or even smaller pick-ups, they don’t want any more taxes at all.

This information comes from a great new poll by my friend Raghavan Mayur, who runs “Techno-Metrica Market Intelligence,” which often contracts through Investors Business Daily, both of which are now owned by Newscorp.

Mr. Mayur has been a top three accurate pollster for the last five presidential elections. Several times, he’s ranked number one. He and I have been pals for a long while, and a couple of weeks ago, he emailed me to ask whether I would be interested in a bunch of economic or tax-related polling questions.

Of course, I said yes. Mayur termed the results quote “fascinating.” They show that if higher taxes cost jobs, then folks don’t want higher taxes. I’ve been dying to ask this question for decades.

It’s so easy for a pollster to ask a voter something like “Well, why not tax the rich or rich corporations or rich investors or rich inheritances?” A lot of voters will shrug their shoulders and say, “Sure, go get them.” But when it turns out that there’s an economic cost in the form of lower jobs, then opinions change.

I would argue, as I have for more than 40 years, that higher tax rates always cost jobs.If you tax something, you’ll get less of it. incentives matter. and you can’t have a good paying job unless you have a healthy business. And you’re not going to either maintain healthy businesses or start new ones without investor cash.

So if you wage tax war against businesses and investors,

you’re really waging economic war against blue-collar, middle-class working persons who make up the vast majority of the nearly 160-million strong labor force. that’s called supply side economics — the Laffer curve.

I really think, though, that it’s plain, old simple horse sense. People who work in business, in contrast to Ivy League faculty members, understand this full well. So let’s take a look at some of the results.

The first chart is raising corporate taxes. The mention of job losses reduces support for corporate tax hikes overall from to 44% from 60%. That’s a huge, 16-point drop. Even in the case of Democrats who love their class warfare, their support drops 15 points — to 60% from 75%.

Now, this is not just an arbitrary threat of job loss. I would argue that periods of heavy tax hikes, like the 1930s or the 1970s, produce huge job losses. Whereas periods of big tax cuts like the 1920s and JFK’s 1960s, the Reagan 1980s and recently the Trump pre-pandemic tax cuts, all produce huge job gains.

Not everybody agrees with this supply-side view. Okay, fine. I respect that. Right now, though, facing a three trillion- or four trillion-dollar Biden tax hike, some highly respectable sources are predicting devastating job losses.

You may not agree with the Tax Foundation, or the Wharton-Penn model, or the Nam-Rice model, but they are all predicting similarly large economic and job losses as a result of across the board tax hikes.

So if you’re going to ask voters what they think about tax hikes, you need to inform them that they “could” result in big job losses.

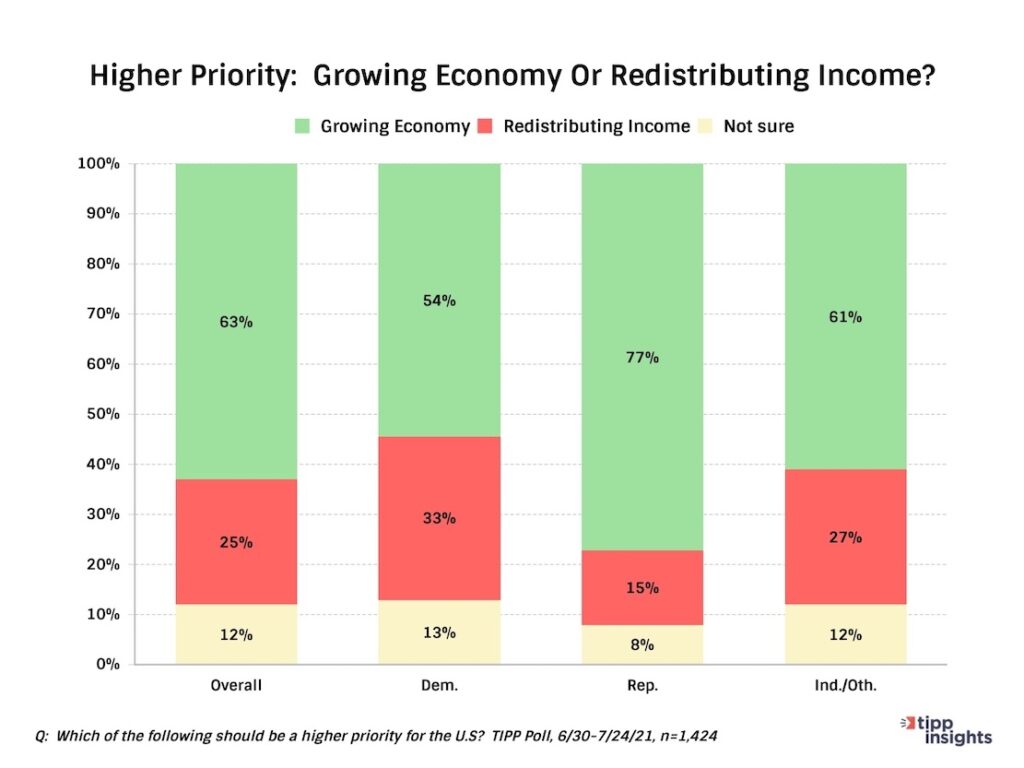

Here’s some more on the subject. With all the talk today of critical race theory and so-called racial equity, Mr. Mayur asked “Which is a higher priority? Growing the economy or redistributing income?” Look at the results. Growth wins big, even among our Democratic friends. It’s 54 to 33 favoring growth.

Do you hate wealthy investors and want to raise their capital gains tax? Well, the threat of job losses reduces overall support for that from to 37% from 47%. Even Democratic support drops by 12 percentage points.

How about raising the estate tax? Well, it turns out almost nobody wants to do this anyway. It seeks as if even our liberal friends don’t think death should be an increasingly taxable offense.

Now, let’s go global. This business of Group of Seven, Group of 20 tax policies supported by Team Biden and their euro friends is not particularly popular in the first place. When you mention the potential for job losses, though, popularity plunges across the board by 12% or 13%.

Then when you ask whether the United States should be giving up its tax sovereignty to globalists like the G-7 or G-20, nobody much likes it at all. So, I would recommend to my Republican and conservative friends — and even fair-minded independents and democrats — that the best way to beat the Biden tax hikes is to emphasize the threat of job losses over and over again.

_______

From Mr. Kudlow’s broadcast on Fox News.

![]()

Lawrence Kudlow is a Fox News host and former Director of the National Economic Council.