The new year will bring another round of wage increases for state employees and a new payroll deduction for everyone else, and House Republicans are calling of Gov. Ned Lamont to suspend both in light of the pandemic.

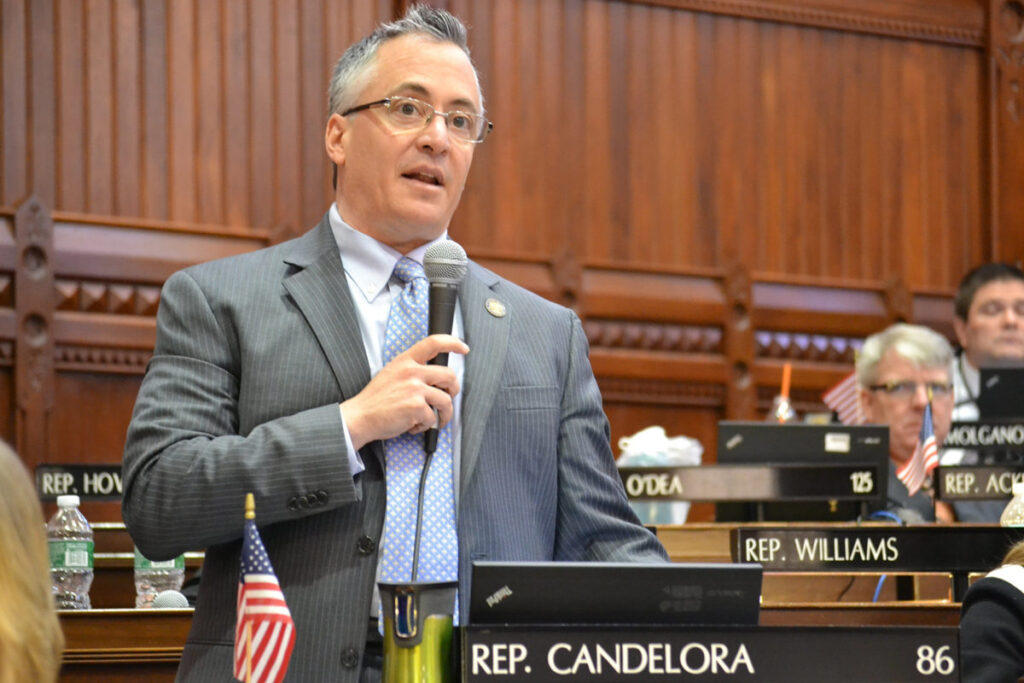

“Main street businesses are struggling under the weight of this pandemic, and their employees even more so. Meanwhile, state government chugs along unaffected—those non-frontline workers still have their jobs, they’re still collecting paychecks,” said House Minority Leader-elect Vincent Candelora, R-North Branford. “Letting these scheduled increases go through right now sends an awful message to Connecticut’s lowest wage workers and those hit hardest in this pandemic.”

The state employee wage increases in January are estimated to cost $34 million, part of an overall two-year $350 million wage increase set in place by the 2017 SEBAC agreement made between the State Employee Bargaining Agent Coalition and Gov. Dannel Malloy.

The agreement offered two general wage increases of 3.5 percent that went into effect on July 1 of 2019 and 2020, along with two step increases generally valued at 2 percent on January 1, 2020 and 2021.

In the lead up to the last general wage increase in July of 2020, Republicans called for Gov. Ned Lamont to suspend the wage increases. Lamont, at the time, said that he supported suspending the raises for non-frontline state employees but that the unions refused and there was nothing he could do because of the SEBAC contract.

Similarly, when the University of Connecticut asked unionized professors to delay their pay raises in order to save some the university’s sports programming, the union likewise refused saying they had sacrificed enough already after years of wage freezes.

The July wage increases came at a time when hundreds of thousands of Connecticut residents were put out of work due to Lamont’s executive order closing all non-essential businesses. The closures primarily affected low-wage workers in the restaurant and hospitality industry.

January will also see a new .5 percent payroll deduction for employees in Connecticut to support the state’s paid Family and Medical Leave program, although the benefits of the program won’t be available until 2022.

The deduction will apply to any employee working for a company with 2 or more employees, estimated at 1.7 million workers in Connecticut, but state employees are exempt from the payroll deduction. Lamont recently dismissed calls for delaying the FMLA payroll tax.

“It’s made worse by the fact that workers scheduled to receive the pay raises, such as unionized state lawyers, are exempt from the new payroll tax that’ll be paid by those in the private sector who worry every day about their job security,” Candelora said.

Connecticut’s job recovery from the pandemic shutdown has slowed and even slid backwards, with the last jobs report noting a loss of 1,600 jobs after months of gains.

Connecticut’s budget, on the other hand, is not quite as dire as original projections warned. Connecticut current fiscal year budget deficit declined to $640 million, bolstered, in part, by gains on Wall Street for Connecticut’s financial sector and the state’s tax on corporations.

However, the budget deficits for the future fiscal years remain hovering around $2 billion per year with Connecticut’s Rainy Day Fund balance at $3 billion.

That Rainy Day Fund balance has allowed Lamont continue to operate the state without making dramatic cuts or suspending scheduled state employee wage increases.

But the optics of state employees receiving wage increases and a new payroll tax during a time of high unemployment, business closures and the lingering threat of further business restrictions could linger for Lamont.

“Governor Lamont punted on the chance to delay pay raises in June as employers and workers came to grips with the financial impact of mandated business closures, guidelines, and restrictions,” Candelora said. “So many residents, and low wage workers in particular, need every dollar in their paycheck. We have to demonstrate to our business community and critical nonprofit providers that we grasp the gravity of the challenges faced by their employees and clients. This is an opportunity to do that—he should delay the raises and payroll tax.”

![]()