Our Nov. 29 editorial called on Gov. Ned Lamont and the legislature to deal meaningfully with Connecticut’s spending habits amid an intensifying fiscal crisis. Data released since then make it all the more essential that Gov. Lamont and lawmakers go this route.

In late November, the legislature’s Office of Fiscal Analysis (OFA) concluded Connecticut faces a deficit in excess of $4 billion, over the current 2020-21 fiscal year and the two succeeding fiscal years. OFA staff took the COVID-19 pandemic into account. Subsequent data paint an even more unsettling picture.

Reporting Dec. 2 on new OFA data, Marc E. Fitch of the Yankee Institute for Public Policy wrote, “Connecticut’s fixed costs like Medicaid, debt service and retiree benefits continue to grow faster than state revenue and make up 52% of the state’s budget.” Continuing, Mr. Fitch noted, “In fiscal year (2020-21), Connecticut will spend $11.46 billion per year on its fixed costs between the General Fund and the Special Transportation Fund, but that figure is projected to grow to $13.54 billion by 2024 when it will consume nearly 55% of the state budget.”

Mr. Fitch also highlighted OFA data indicating fixed-costs growth will exceed revenue growth until at least 2024, and that post-2024 prospects are uncertain because of the pandemic. Gov. Lamont’s Office of Policy and Management noted a similar trend, the Republican-American reported Dec. 11. The annual state budget is a little more than $22 billion.

These data point to a distinct threat to Connecticut’s economic health. Democratic Gov. Lamont and the Democratic-controlled legislature will not officially begin working on the 2021-23 budget until February, but they should start planning in earnest.

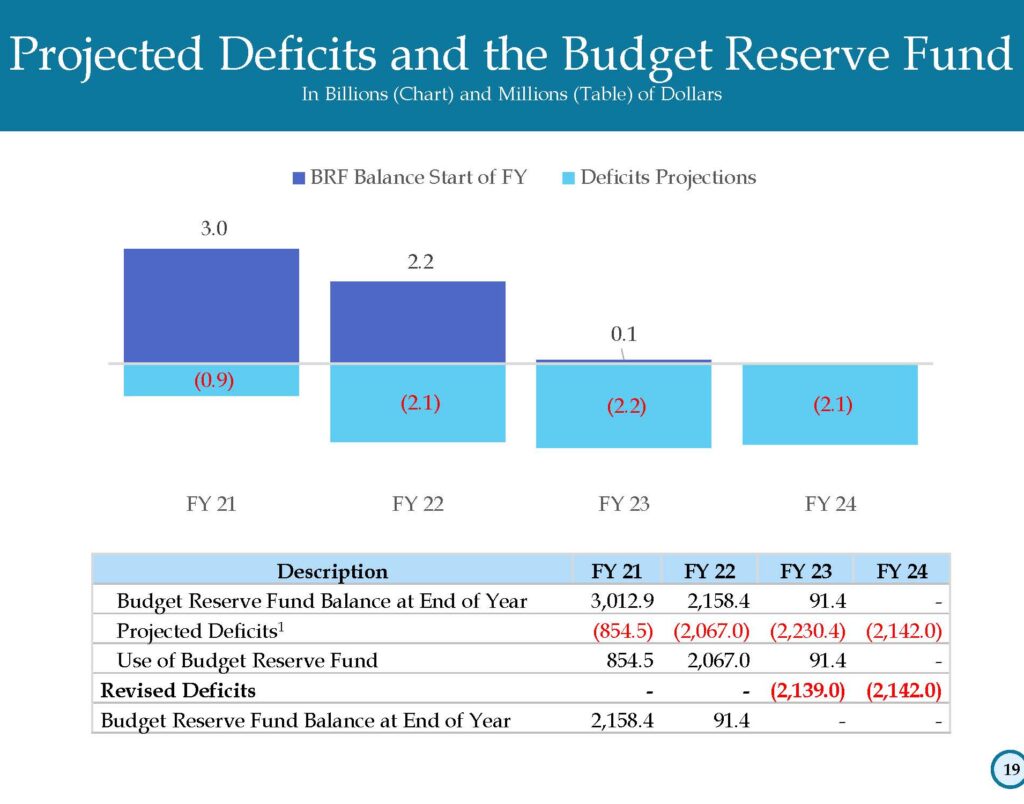

In the Nov. 29 editorial, we asserted that tax increases are not a viable solution; and Connecticut’s rainy day fund only can be relied on so much. We now reiterate these points.

The state income tax, which was imposed in 1991, did not live up to then-Gov. Lowell P. Weicker’s prediction that it would permanently stabilize Connecticut’s finances. Indeed, as Mr. Fitch noted, the state witnessed sizable tax increases in 2009, 2011 and 2015. As for the rainy day fund, the $3 billion balance it has at present won’t even get the state through the 2021-23 biennium (July 1, 2021 through June 30, 2023).

This leaves spending reductions as the only options. Personnel costs have to be part of the solution.

July 1 will mark the expiration of the no-layoff guarantee afforded most unionized state employees by then-Gov. Dannel P. Malloy’s 2017 “concessions” deal with the State Employees Bargaining Agent Coalition (SEBAC). This means that when the new biennium begins, Gov. Lamont can assess the state workforce and eliminate any bloat.

Indeed, the governor can use the mere threat of layoffs to secure meaningful concessions. They are sorely needed: while the 2017 SEBAC deal required all state employees to increase their annual pension contributions, they now contribute no more than 4% of their salaries – as compared with the 7% national average for state employees.

Right now, Connecticut’s system is screaming red. The same old way of doing things – increasing taxes and coddling Big Public Labor – will not suffice. What Gov. Lamont and legislators do to confront these problems will tell whether they are true leaders or mere servants of their benefactors in the labor movement.

![]()