The Connecticut General Assembly session has now concluded with the adoption of a revised budget for the biennium of fiscal years 2022 and 2023.

Happily, Democrats conceded to half of the GOP’s proposed $1.2 billion tax cut plan.

Yet, Governor Lamont rejected a major element of the GOP plan: a proposal to use off-budget American Rescue Plan (ARP) money to repay hundreds of millions of still-outstanding federal loans received by Connecticut over the last two years to fund unemployment insurance benefits.

Apparently, that proposal has been squashed, with Lamont agreeing to repay only $40 million.

Why was a loan repayment proposal part of a tax-cut plan? Because otherwise these loans will have to be repaid with hefty tax increases on employers in the state.

Furthermore, why did the GOP combine on-budget tax proposals with this proposal concerning the off-budget ARP program? Because, to date, hundreds of millions of ARP money have been earmarked to close previously expected budget deficits.

As recently as February, Gov. Lamont was still planning to spend $940 million of ARP funds to close budget deficits, including $215 million to close a deficit for the soon-ending fiscal year 2022 – despite that Lamont’s own February budget proposal projected a $1.5 billion general fund budget surplus for fiscal 2022.

After the release of Lamont’s budget proposal with its big projected surplus, Republicans went to work on their tax cut plan. The plan that emerged included about $1.0 billion of on-budget tax cuts and a $225 million dollar repayment of the federal loans, with the obvious idea that the $215 million of ARP money still earmarked for deficit reduction this fiscal year would not be needed.

The GOP plan was conceived before the Office of Policy and Management announced in April an enormous $500 million increase over Lamont’s forecasted $1.5 billion budget surplus for the fiscal year 2022.

Surely, it was this increase which pushed Democrats to concede and agree to half the GOP-recommended increase in on-budget tax cuts, about $600 million in mostly one-time reductions scheduled to end by fiscal year-end 2023.

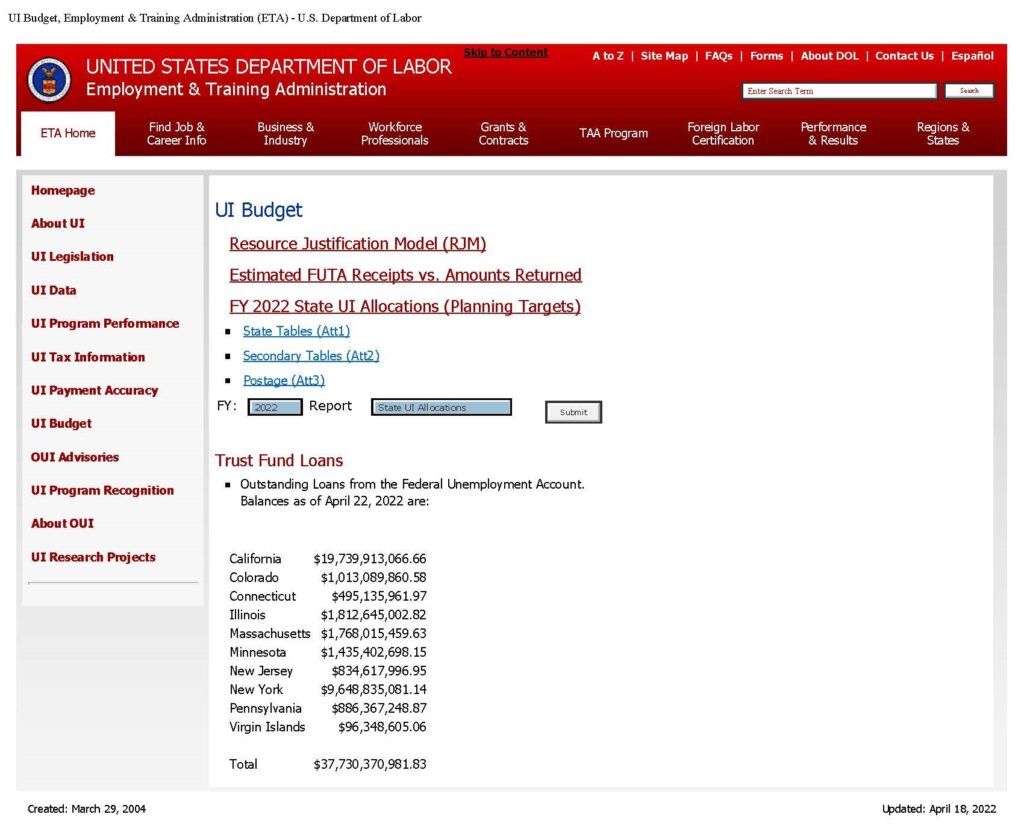

Reportedly, the huge surplus sparked discussions about repaying $400 million of the $495 million federal loans outstanding.

The case for repayment couldn’t be more straightforward and compelling. Indeed, Lamont himself had embraced it earlier on, already having repaid $155 million with ARP money, which, however, has left the $495 million still outstanding.

His $40 million commitment now is miserly and unjustifiable. In February, he had designating $725 million of ARP money for “revenue replacement” in fiscal 2023. With this spring’s huge budget surpluses, what are his plans for this money?

More social safety-net and social welfare spending would be quite risky, because such spending would be difficult to terminate after the one-time infusion of ARP money has run out.

When has social safety-net or social welfare spending of any kind ever been revoked just a year or two after having been initiated?

How likely is it that, if re-elected, Lamont and a Democrat-controlled legislature would discontinue the $1.8 billion ARP-funded spending already launched? And what if they launch more such spending with almost $1 billion of ARP money previously reserved for “revenue replacement” over the next 14 months?

Continuation of this spending after ARP funds have been exhausted would jeopardize the state’s fiscal health.

Continued unfunded spending is not the only financial risk facing the state. So far in 2022, the stock and bond markets have plummeted, severely depressing investment income and prospective income tax revenue from investments. Such income tax revenue reached a whopping $6.1 billion for fiscal 2022. The state’s official revenue forecast calls for only a modest $700 million, or 11%, decline in such income tax revenue in fiscal 2023. What if the decline is more like the 29% decline following the stock market collapse during the Great Recession?

The even greater point is that all government services rely ultimately upon taxes generated by the state’s businesses and its economy in general. Unless the federal loans are repaid by the state, the Connecticut economy will be weighted down by even more taxes on business. Already the state’s 9.0% corporate income tax is one of the highest of the 50 states.

Connecticut’s labor force is still 2% below its level before the pandemic, while 22 states have grown theirs since then. The state’s 4.6% unemployment rate is tied for 6th-highest in the nation.

The Lamont Administration should not have stiffed the state’s businesses. Having done so, certainly it should not spend even more ARP funds on difficult-to-end social welfare and safety-net programs.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.