Just as homeowners must disclose to buyers any known problems with their properties, just as pharma companies must disclose any known adverse side effects with their drugs, and just as IPO issuers must disclose in their prospectuses all the things they can think of that may go wrong, the State of Connecticut should disclose to new residents and businesses the known risks they will face.

Here is the warning label every new resident should receive upon entering CT:

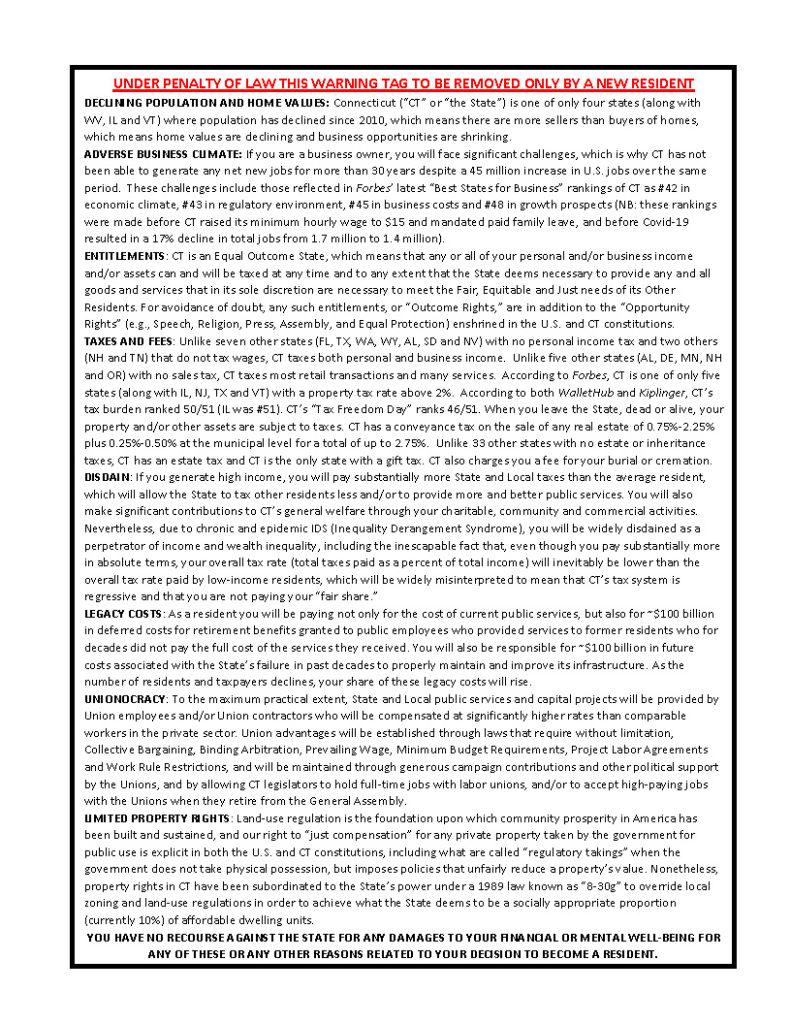

UNDER PENALTY OF LAW THIS WARNING TAG TO BE REMOVED ONLY BY A NEW RESIDENT

DECLINING POPULATION AND HOME VALUES: Connecticut (“CT” or “the State”) is one of only four states (along with WV, IL and VT) where population has declined since 2010, which means there are more sellers than buyers of homes, which means home values are declining and business opportunities are shrinking.

ADVERSE BUSINESS CLIMATE: If you are a business owner, you will face significant challenges, which is why CT has not been able to generate any net new jobs for more than 30 years despite a 45 million increase in U.S. jobs over the same period. These challenges include those reflected in Forbes’ latest “Best States for Business” rankings of CT as #42 in economic climate, #43 in regulatory environment, #45 in business costs and #48 in growth prospects (NB: these rankings were made before CT raised its minimum hourly wage to $15 and mandated paid family leave, and before Covid-19 resulted in a 17% decline in total jobs from 1.7 million to 1.4 million).

ENTITLEMENTS: CT is an Equal Outcome State, which means that any or all of your personal and/or business income and/or assets can and will be taxed at any time and to any extent that the State deems necessary to provide any and all goods and services that in its sole discretion are necessary to meet the Fair, Equitable and Just needs of its Other Residents. For avoidance of doubt, any such entitlements, or “Outcome Rights,” are in addition to the “Opportunity Rights” (e.g., Speech, Religion, Press, Assembly, and Equal Protection) enshrined in the U.S. and CT constitutions.

TAXES AND FEES: Unlike seven other states (FL, TX, WA, WY, AL, SD and NV) with no personal income tax and two others (NH and TN) that do not tax wages, CT taxes both personal and business income. Unlike five other states (AL, DE, MN, NH and OR) with no sales tax, CT taxes most retail transactions and many services. According to Forbes, CT is one of only five states (along with IL, NJ, TX and VT) with a property tax rate above 2%. According to both WalletHub and Kiplinger, CT’s tax burden ranked 50/51 (IL was #51). CT’s “Tax Freedom Day” ranks 46/51. When you leave the State, dead or alive, your property and/or other assets are subject to taxes. CT has a conveyance tax on the sale of any real estate of 0.75%-2.25% plus 0.25%-0.50% at the municipal level for a total of up to 2.75%. Unlike 33 other states with no estate or inheritance taxes, CT has an estate tax and CT is the only state with a gift tax. CT also charges you a fee for your burial or cremation.

DISDAIN: If you generate high income, you will pay substantially more State and Local taxes than the average resident, which will allow the State to tax other residents less and/or to provide more and better public services. You will also make significant contributions to CT’s general welfare through your charitable, community and commercial activities. Nevertheless, due to chronic and epidemic IDS (Inequality Derangement Syndrome), you will be widely disdained as a perpetrator of income and wealth inequality, including the inescapable fact that, even though you pay substantially more in absolute terms, your overall tax rate (total taxes paid as a percent of total income) will inevitably be lower than the overall tax rate paid by low-income residents, which will be widely misinterpreted to mean that CT’s tax system is regressive and that you are not paying your “fair share.”

LEGACY COSTS: As a resident you will be paying not only for the cost of current public services, but also for ~$100 billion in deferred costs for retirement benefits granted to public employees who provided services to former residents who for decades did not pay the full cost of the services they received. You will also be responsible for ~$100 billion in future costs associated with the State’s failure in past decades to properly maintain and improve its infrastructure. As the number of residents and taxpayers declines, your share of these legacy costs will rise.

UNIONOCRACY: To the maximum practical extent, State and Local public services and capital projects will be provided by Union employees and/or Union contractors who will be compensated at significantly higher rates than comparable workers in the private sector. Union advantages will be established through laws that require without limitation, Collective Bargaining, Binding Arbitration, Prevailing Wage, Minimum Budget Requirements, Project Labor Agreements and Work Rule Restrictions, and will be maintained through generous campaign contributions and other political support by the Unions, and by allowing CT legislators to hold full-time jobs with labor unions, and/or to accept high-paying jobs with the Unions when they retire from the General Assembly.

LIMITED PROPERTY RIGHTS: Land-use regulation is the foundation upon which community prosperity in America has been built and sustained, and our right to “just compensation” for any private property taken by the government for public use is explicit in both the U.S. and CT constitutions, including what are called “regulatory takings” when the government does not take physical possession, but imposes policies that unfairly reduce a property’s value. Nonetheless, property rights in CT have been subordinated to the State’s power under a 1989 law known as “8-30g” to override local zoning and land-use regulations in order to achieve what the State deems to be a socially appropriate proportion (currently 10%) of affordable dwelling units.

YOU HAVE NO RECOURSE AGAINST THE STATE FOR ANY DAMAGES TO YOUR FINANCIAL OR MENTAL WELL-BEING FOR THESE OR ANY OTHER REASONS RELATED TO YOUR DECISION TO BECOME A RESIDENT.

![]()

Bud Morten is a resident of Fairfield, CT