Last week, Governor Lamont invoked the KISS principle (Keep It Simple, Stupid) to explain his reordering of the sequence of eligibility for COVID-19 vaccinations. He should not stop there. The entirety of state government could use a rigorous application of the principle.

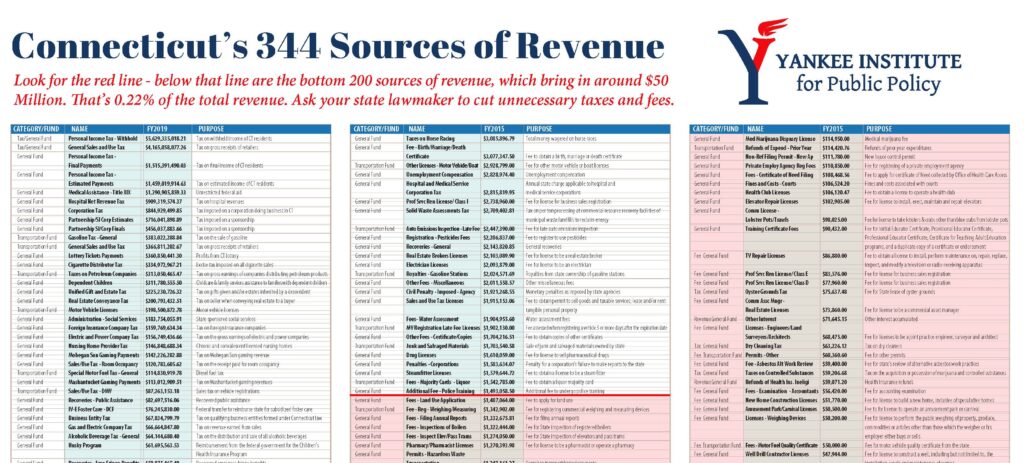

Last year, Yankee Institute released a study of state revenue sources. The study was simple. What it found was not. The study was just a one-page list of all the state’s revenue sources – all 344 of them. The page was oversized, measuring 17 by 22 inches, with the list printed in a font as small as the fine print of an insurance policy.

It is doubtful that anyone in state government has a grasp of it all, including Comptroller Kevin Lembo. The old saying about the left hand not knowing about the right fails to capture the unnecessary complexity. It is more like one hand of the state doesn’t know what the other 99 hands are doing.

That captures the challenge from the perspective of state government. It is much worse from the perspective of businesses and citizens who are being income-taxed, sales-taxed, fee-charged in myriad dimensions.

This is death-by-a-thousand-cuts, a saying that some people might think is just a catchy made-up phrase. It is not. Into the last century, the Chinese used this barbaric method (Lingchi) to torture and kill their enemies and to execute those guilty of heinous crimes. Connecticut’s revenue structure threatens a similar fate for businesses and taxpayers.

Short of death, another image comes to mind, that of Gulliver in Jonathan Swift’s novel Gulliver’s Travels. He was pinned motionless to the ground by the six-inch tall Lilliputians, who bound him with a thousand gossamer strands criss-crossing his body.

With the state’s grasping revenue hand out at every step, it is almost impossible for Connecticut citizens and businesses to move… except out of the state. The red tape is suffocating.

Back on the state’s side, the task of overseeing all this is daunting. There’s a cost of administration, namely costs of collection and costs of enforcement.

Of the 344 revenue sources discovered by Yankee, the bottom 200 raised only about $50 million in 2019, or less than 0.25% of total state revenue. Why bother?

Really. Does it make sense to collect an annual total of about $14,000 in registration fees from professional hypnotists?

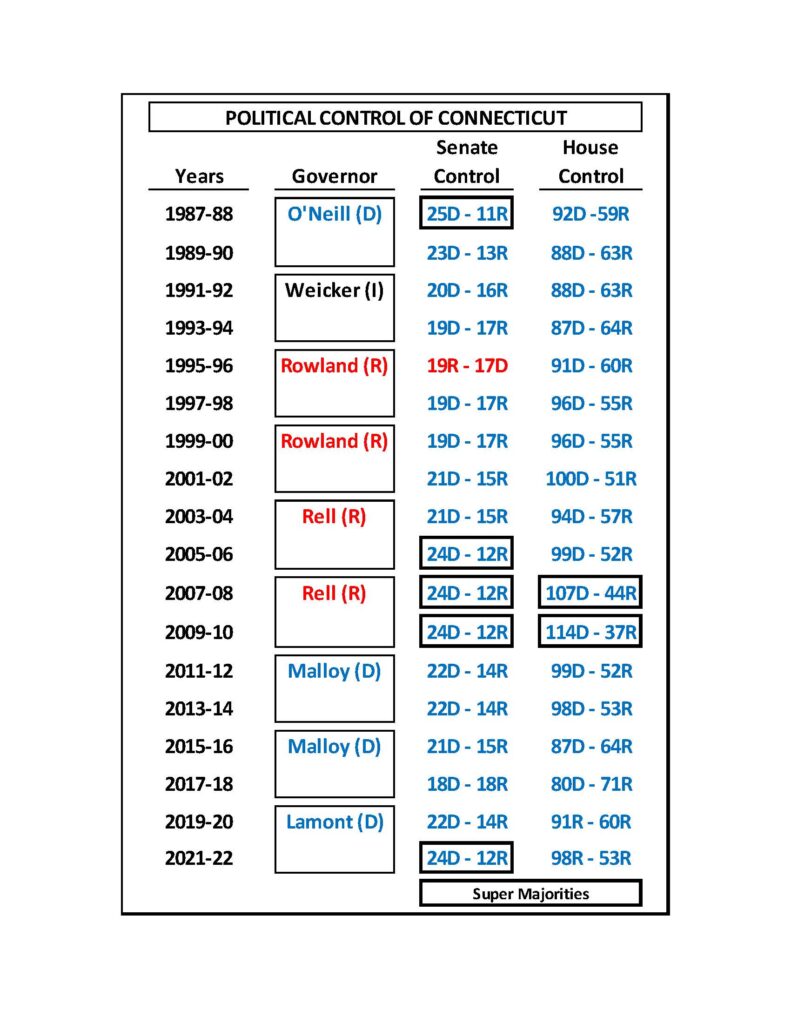

The real problem is that the state is desperate for revenue. Nevertheless, Hartford Democrats who have controlled both houses of the state legislature for the last 35 years, but for one two-year Senate term, are deathly afraid to increase what Governor Lamont refers to as “major taxes.” They’re afraid because they have raised these highly visible taxes, including the income tax, so many times and by so much over that span, that they worry that overtaxed voters will finally throw them out of office.

So, they pass many different small tax increases in the hope that voters will not notice. In 2019 Lamont and the Democrats instituted a massive expansion of the sales tax, applying it to hundreds of new items.

Yet, the huge state apparatus that Democrats have created over more than three decades is so needy of revenue that Democrats cannot meet its needs only by siphoning small, hopefully unnoticed, amounts from the state’s harried taxpayers.

In Lamont’s last budget, he tried to go big with a plan to raise hundreds of millions via a vast network of highway tolls. He discovered that taxpayers are “woke.” A grass roots movement defeated the tolls project resoundingly.

Yet the governor is back this year with another variation on this theme, a new gas tax on big trucks.

On top of the new truck tax, the new one-half percent paid leave tax is taking effect this year, hitting everyone in the state, with the exception only of state employees.

Lamont and the Democrats seem oblivious to the negative psychology that their never-ending expansion of taxes has created and continues to instill.

Maybe Democrats should recognize the toxic tax-everything environment they have created and rethink the behemoth that they have created in Hartford that requires ever more revenue with every new budget cycle.

Lamont has said he wants more taxpayers, not more taxes. He would attract more of the former by eliminating a lot of the latter. He could begin with the bottom 200 on Yankee’s list, which would be consistent with his recent embrace of the KISS principle.

![]()

Red Jahncke is a nationally recognized columnist, who writes about politics and policy. His columns appear in numerous national publications, such as The Wall Street Journal, Bloomberg, USA Today, The Hill, Issues & Insights and National Review as well as many Connecticut newspapers.

Another great column, Red!

And, what are the odds that it costs more to administer and collect many or most of the bottom 200 taxes and fees than the State actually collects? Pretty good, I’d guess…but if you stop collecting these taxes and fees where would the State employees work? In a state where jobs are leaving and not coming?

Red:Congratulations to you and the Yankee Institute on proposing a great application of the KISS principle to the CT tax system! Governor Lamont is holding the line against what may be the majority of his party in the Legislature in resisting tax increases, and he should be applauded for that. (And I would give him a pass on his proposal for new truck taxes, given the unsustainability of the Special Transportation Fund.) But Yankee’s data showing that the bottom 200 of the state’s 344 revenue sources raise only about $50 million, or less than 0.25% of state revenues, screams out for action by… Read more »

Glad to see bipartisan support for tax simplification! If I were a Democrat legislator, I’d love to be able to say that I supported a bill eliminating dozens of taxes–it’s a great issue waiting for someone to champion.